What You Have to Know

- With many asset teams not but screaming financial angst, one bullish mantra is beginning to emerge from the noise: Purchase the dip.

- Panicked strikes had been the theme of the week, notably Monday.

- Nonetheless, virtually as shortly because it blew up, volatility eased, and the S&P 500 staged its greatest rally since 2022.

It began, innocently sufficient, in markets, when high-flying tech shares began giving again features that just about all of Wall Avenue was satisfied had gone too far.

Roughly a month right into a trauma that expanded this week to embody all the pieces from emerging-country currencies to Japanese shares — earlier than defusing virtually as quick — lots of people anxious in regards to the financial system are hoping markets are the place it can keep.

A signature truth of the worst turbulence of 2024 stays how a lot of it’s confined to excesses wrought by merchants. Speculators exploiting an ever-weakening yen bought chased out of cross-border wagers. Quants who’d been ringing up features for months suffered a comeuppance. Widespread choices bets premised on calm briefly blew up.

Briefly, whereas financial fears lit the match that fueled the selloff’s loudest bursts, a daisy chain of leverage drove a slew of market reversals that muddy the potential recessionary message from slumping shares — to everybody from retail day merchants to Jerome Powell, who appears to be like poised to decrease charges in September.

With a slew of asset courses and sectors not but screaming financial angst, one bullish mantra is starting to emerge from the noise: Purchase the dip.

“It’s a wholesome correction for now. Crowded positions and panic resulted in accelerated selloff,” mentioned Vineer Bhansali, founding father of the Newport Seaside, California-based asset supervisor Longtail Alpha. “The momentum commerce made everybody very lengthy a concentrated set of positions, and exit liquidity is dismal.

For buyers resisting the urge to promote, it might be the strongest plank within the bull case. And whereas anybody saying it’s all an overreaction should reply to the steep drop in bond yields — as near an unambiguous signal that the financial system is in hassle as markets ever ship — those that caught it out had been rewarded as volatility receded at week’s finish.

“Once you get these violent strikes, the market at all times overshoots, and that’s precisely what occurred,” mentioned Michael de Move, international head of charges buying and selling at Citadel Securities. “It was an overshoot pushed by a bond market that had loads of room to rally given the place present fed funds ranges are.”

One factor’s for positive: regardless of reversing simply as quick this week — equities and bonds each — the nice August swoon of 2024 has turn out to be front-page information, offering ammo within the U.S. presidential race and ramming into the favored consciousness fears of a U.S. recession or monetary-policy error.

Ought to it resume, the potential exists for severe international tumult, sweeping up carry merchants in Tokyo, emerging-market buyers in Mexico and volatility professionals in New York.

Panicked strikes had been the theme of the week, notably Monday, when Japan’s Topix tanked 12%, the Cboe Volatility Index surged 42 factors within the area of some hours and losses within the S&P 500 at one level surpassed 4%.

All of sudden, international merchants who’d been using dangerous belongings to features for months misplaced their nerve. Weakening U.S. labor knowledge satisfied many the Fed had waited too lengthy to chop charges, main them to dump shares after US Treasury yields staged the greatest one-week slide since 2008 final week.

Particularly harsh for skilled buyers was disruption of a in style technique the place cash borrowed within the Japanese forex is used to fund purchases of higher-yielding belongings elsewhere — the so-called carry commerce — which shuddered because the yen appreciated for 5 straight weeks.

The amount of cash concerned is disputed — estimates vary from tens of billions of {dollars} into the trillions — however its unwinding was notably pronounced in Asia, the place an MSCI index monitoring the area swooned 6% to start out the week.

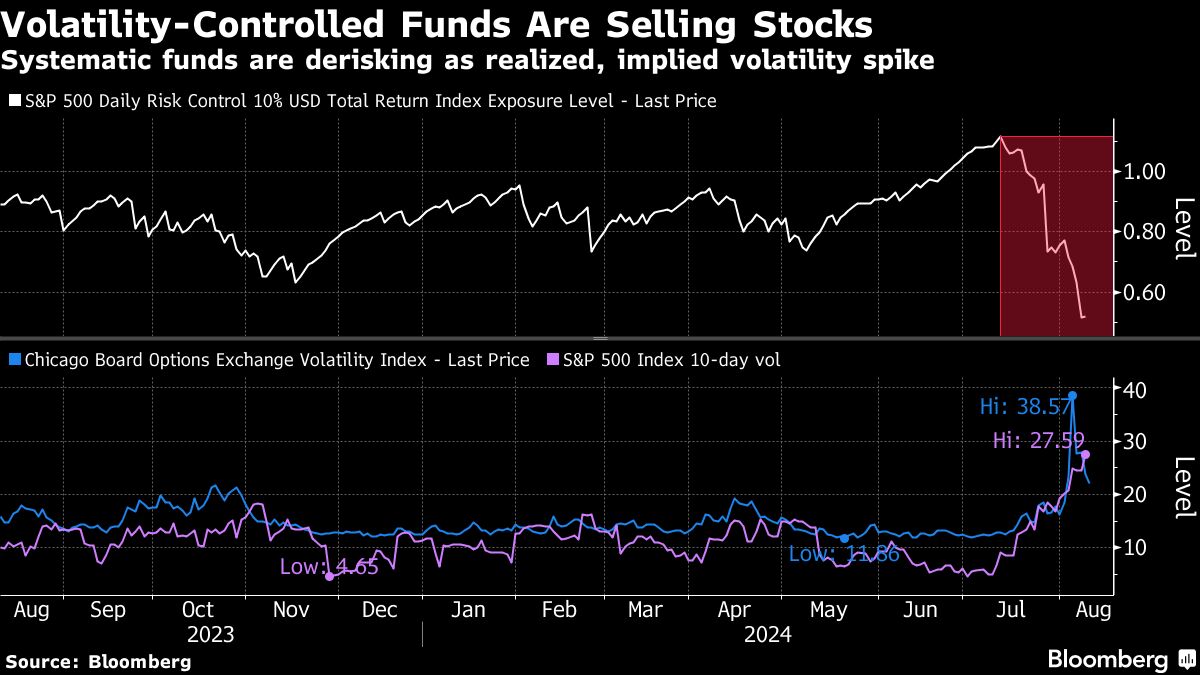

Elsewhere among the many professional class, systematic funds that use volatility as a sign to purchase or promote belongings rushed to exit equities and cargo up on bonds and money. So tranquil had markets been within the runup to July that one class of volatility-controlled funds had pushed its allocation to equities to 110%.