Enrollment in ACA market plans has surged, because of expanded eligibility for ACA market subsidies. Main that surge: consumers with greater incomes.

Enrollment climbed as extra consumers gained subsidy eligibility

After the American Rescue Plan (ARP) expanded eligibility for premium subsidies within the ACA market in 2021, enrollment in 2022 plans elevated by 21%. Enrollment in 2023 plans is on tempo to develop by one other 13%, to about 16.4 million by the point the open enrollment period ends in all states. Plainly, People who lack entry to reasonably priced employer-sponsored well being plans, Medicaid, or Medicare are recognizing that the ARP made well being plans within the ACA market much more reasonably priced.

The ARP elevated premium subsidies within the ACA market at each earnings degree and eliminated the earnings cap on subsidy eligibility, which had been 400% of the Federal Poverty Degree (FPL) for the reason that ACA market launched in 2014. In 2023, 400% FPL is $54,360 for a person and $111,000 for a household of 4. Enrollees with earnings above that degree used to pay the total premium with out subsidy. Now they obtain premium subsidies if the unsubsidized benchmark Silver plan premium would price them greater than 8.5% of annual household earnings.

The desk under exhibits the enrollment improve at every earnings degree for 2022 plans within the 33 states that use HealthCare.gov, the federally run trade. Whereas enrollment in 2022 protection rose by double-digit margins in any respect reported earnings ranges, the expansion price elevated with earnings and was highest at incomes over 400% FPL – i.e. amongst these previously ineligible for subsidies. (Details about 2023 enrollees’ earnings is just not but out there.)

A be aware on one information limitation: the chart combines enrollment by these with incomes under 100% FPL and above 400% FPL as a result of that’s the way in which CMS reported earnings in 2021, when enrollees with incomes over 400% FPL weren’t eligible for subsidies. In 2022, 146,297 enrollees in HealthCare.gov states had earnings under 100% FPL, whereas 655,944 reported earnings above 400% FPL – so possible nearly all the improve in that mixed class is attributable to enrollees with incomes above 400% FPL.

An apparent surge in enrollment at earnings ranges over 400% FPL

In 2022, the primary yr by which there was no earnings cap on subsidies, enrollment at incomes above 400% FPL greater than doubled. Once you have a look at premiums with and with out subsidies for enrollees of various ages, as proven under, it’s not onerous to see why.

Protection is a lot extra reasonably priced at incomes above 400% FPL than it was previous to 2022 – much more so than many individuals who checked out market choices earlier than they turned subsidy eligible in all probability acknowledge. Word additionally that the variety of enrollees who didn’t report earnings plummeted. That’s probably as a result of the ARP dramatically lowered the variety of enrollees who earn an excessive amount of to acquire a subsidy.

Enrollment Improve by Revenue 2021-2022

|

||||||||

|---|---|---|---|---|---|---|---|---|

| Platform and yr | 2022 enrollees – all incomes | 100-150% FPL | 150-200% FPL | 200-250% FPL | 200-250% FPL2 | 300-400percentFPL | <100% FPL or >400% FPL | Unknown earnings |

| Complete HC.gov 2021 (2022 states) | 8,071,160 | 3,341,683 | 1,526,852 | 1,047,400 | 646,920 | 717,830 | 290,957 | 499,518 |

| Complete HC.gov 2022 | 10,255,636 | 4,144,112 | 1,852,059 | 1,316,029 | 860,181 | 937,198 | 802,241 | 343,816 |

| Change 2021-2022 – HC.gov | 2,184,476 | 802,429 | 325,207 | 268,629 | 213,261 | 219,368 | 511,284 | -155,702 |

| % Change 2021-2022 – HC.gov | 27.1% | 24.0% | 21.3% | 25.6% | 33.0% | 30.6% | 175.7% | -31.2% |

Supply: 2022 Marketplace Open Enrollment Public Use Files / CMS.gov

The enrollment surge, illustrated

Let’s take a better have a look at one of many ACA’s hottest markets: Houston, Texas. Enrollment in 2022 protection in Texas elevated by 42%, and enrollment in 2023 plans is on tempo to extend one other 32%. The chart under exhibits what premiums now seem like for {couples} of various ages with an annual earnings of $74,000 – barely above the 400% FPL threshold – in comparison with what these {couples} would pay in the event that they have been ineligible for subsidies, as they’d have been in years earlier than 2022.

The supply for all premiums quoted under is the “See plans and prices” software on HealthCare.gov.

Influence of the American Rescue Plan on ACA premium subsidies

Month-to-month premiums paid with and with out ARP subsidy will increase: Houston, TX in 2023

Married 40-year-olds, annual earnings $74,000 (404% FPL) |

|||

|---|---|---|---|

| Authorized standing | Lowest-cost Bronze | Lowest-cost Silver | Lowest-cost Gold |

| ARP in impact | $261 | $523 | $393 |

| No ARP | $624 | $887 | $756 |

Married 63-year-olds, annual earnings $74,000 (404% FPL) |

|||

|---|---|---|---|

| Authorized standing | Lowest-cost Bronze | Lowest-cost Silver | Lowest-cost Gold |

| ARP in impact | $0 | $522 | $222 |

| No ARP | $1,441 | $2,047 | $1,747 |

Discover that the premiums that the older couple pays (after subsidy) for Bronze and Gold plans are a lot decrease than these paid by the 40-year-olds. That’s as a result of premiums earlier than subsidies are credited rise with age: At age 64, they’re thrice the premium for a 21-year-old and greater than twice the premium for a 40-year-old.

However subsidies are structured so that everybody with the identical earnings pays the identical quantity for the benchmark Silver plan: An enrollee with earnings at >400% of FPL receives a subsidy in a set quantity that permits the enrollee to pay no more than 8.5% of their earnings for the benchmark, no matter age. So the subsidy for the older couple is larger than for the youthful couple.

When the subsidy will get larger, it covers a bigger share of the premium for plans that price much less than the benchmark plan. Because the “unfold” between the benchmark plan’s premium and the premiums for cheaper plans (one Silver and lots of Bronze plans) will increase in proportion to the age of enrollees, older enrollees get larger financial savings on cheaper plans.

Louise Norris has more on how the ARP has decreased premiums for older enrollees. For eligible greater earnings and older enrollees, the ARP subsidy boosts should not simply an “8.5% resolution.” Protection, together with generally Gold protection, is usually out there for a lot much less.

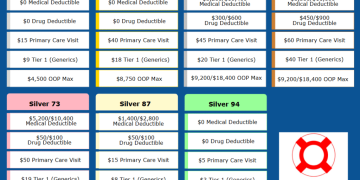

What do the lowest-cost Bronze, Silver and Gold plans proven above seem like? Under are some key options. Word that in ACA market plans, choose options is probably not topic to the deductible, that means you don’t should pay full value earlier than you meet your deductible (i.e. a service could also be free or it’s possible you’ll pay solely a co-pay).

- The lowest-cost Bronze plan on this market from Blue Cross Blue Defend of Texas, has a deductible of $7,400, and an annual out-of-pocket most of $9,100 (the very best allowable by legislation). Major care physician visits are free no matter whether or not the plan’s deductible has been met, and generic drug prescriptions are $5, additionally earlier than the deductible.

- The lowest-cost Silver plan, from Ambetter, has a $5,800 deductible and an $8,900 out-of-pocket max. Major care visits are $40 and generic drug prescriptions are $20, each earlier than the deductible, and different companies (pressing care, specialist visits) are additionally not topic to the deductible.

- The lowest-cost Gold plan, from Blue Cross Blue Defend, has a deductible of $1,100, an out-of-pocket max of $9,100. Major care physician visits are free and generic drug prescriptions of $5, neither topic to the deductible.

Bargains are Gold-plated in Texas and a handful of different states

The tables additionally present an additional profit within the Texas market. In 2022, the Texas legislature unanimously passed a law, signed by Gov. Greg Abbott, instructing the Division of Insurance coverage to difficulty laws that might be certain that insurers value Gold plans decrease than Silver plans. How can that be?

Nicely, most market enrollees have incomes under 200% FPL, and under that threshold, Price Sharing Discount (CSR) subsidies give Silver plans decrease out-of-pocket prices than Gold plans. In Texas in 2022, 88% of Silver plan enrollees had earnings under 200% FPL. So, setting Gold plan premiums under Silver premiums is a serious profit to enrollees with incomes above 200% FPL, for whom Gold plans have decrease out-of-pocket prices than Silver.

Not less than six states have taken measures to have Gold plans constantly priced under or on a tough par with Silver, and in different states and areas, insurers have completed so on their very own. This post by Charles Gaba spotlights states and counties by which the financial upsides for Gold plans are most excessive.

Pricing CSR straight into Silver plan premiums is a apply often known as “silver loading,” which began in 2018 after the federal authorities stopped paying insurers individually for the worth of CSR. Silver loading creates reductions in Bronze in addition to Gold plans – typically wiping out the Bronze premium totally, because the chart above illustrates within the case of the 63-year-olds. Insurers in all states besides Mississippi and Indiana apply Silver loading to some extent.

When premiums go excessive, so does subsidy eligibility

At an earnings of $150,000 per yr for a few 40-year-olds – greater than 800% FPL for a two-person family – the unsubsidized benchmark Silver plan in Houston prices lower than 8.5% of earnings. The premium could be the identical if the ARP weren’t in impact.

Married 40-year-olds, annual earnings $150,000 (819% FPL) |

|||

|---|---|---|---|

| Authorized standing | Lowest-cost Bronze | Lowest-cost Silver | Lowest-cost Gold |

| ARP in impact | $624 | $886 | $756 |

| No ARP | $624 | $886 | $756 |

For 2 60-somethings, nevertheless, the benchmark premium rises so excessive that it’s greater than 8.5% of earnings even for a pair incomes $150,000. Subsidies due to this fact kick in even at this excessive earnings.

Married 63-year-olds, annual earnings $150,000 (819% FPL) |

|||

|---|---|---|---|

| Authorized standing | Lowest-cost Bronze | Lowest-cost Silver | Lowest-cost Gold |

| ARP in impact | $455 | $1,061 | $761 |

| No ARP | $1,441 | $2,047 | $1,747 |

These prohibitively excessive unsubsidized premiums could seem to be an excessive case, however they’re commonplace for older enrollees. Offering reasonably priced insurance coverage to individuals who retire or are laid off earlier than they’re eligible for Medicare is a serious operate of the ACA market. In 2022, 28% of all enrollees have been aged 55-64.

The ARP in fact made plans considerably extra reasonably priced at each earnings bracket under 400% FPL as effectively. Examples of how the subsidy will increase have an effect on enrollees at numerous earnings ranges are specified by this post.

Will high-earner enrollment proceed to surge?

The American Rescue Plan was initially designed as COVID-19 aid, and the subsidy will increase within the ACA market have been solely granted by means of 2022. The Inflation Reduction Act, enacted in August 2022, prolonged the elevated subsidies by means of 2025. Past that time, their future is unsure, although they’ve plainly helped to cut back the uninsured inhabitants nationwide.

Not less than by means of 2025, if it is advisable to discover insurance coverage within the particular person market and haven’t but examined your choices, you’re more likely to be pleasantly shocked – significantly for those who have been jolted by unsubsidized premiums previously and now end up eligible for sponsored protection.

Andrew Sprung is a contract author who blogs about well being care coverage and ACA implementation at xpostfactoid and at healthinsurance.org. His articles have appeared in publications together with Well being Affairs, The American Prospect, USA At the moment, The New York Occasions, The Incidental Economist, Mom Jones, The Atlantic and The New Republic. He’s the winner of the Nationwide Institute of Well being Care Administration’s 2016 Well being Care Digital Media Award and holds a Ph.D. in English literature from the College of Rochester.

[author_name]