Well being financial savings accounts (HSAs) supply unimaginable tax advantages for people enrolled in high-deductible well being plans (HDHPs). Given the current announcement of the 2026 HSA contribution limits, now is a perfect time to reassess your well being plan choices. Consequently, understanding how these up to date limits may affect your decisions for the approaching 12 months is extra essential than ever.

What’s New in 2026 for HSAs?

For 2026, the IRS has elevated the contribution limits for HSAs:

- Self-only protection: $4,400 (up from $4,300 in 2025)

- Household protection: $8,750 (up from $8,550 in 2025)

These will increase are according to inflation changes. In addition they present extra room for people and households to save lots of for healthcare bills.

HSAs present three key tax benefits:

- Tax-deductible contributions: You possibly can deduct the quantity you contribute to your HSA out of your taxable revenue.

- Tax-free development: Your HSA stability grows with out being taxed.

- Tax-free withdrawals: If you use the funds for certified medical bills, you don’t pay taxes on the withdrawals.

Understanding Excessive-Deductible Well being Plans (HDHPs)

To qualify for an HSA, you have to be enrolled in a high-deductible well being plan. The IRS defines a high-deductible plan as one which meets these necessities:

- Self-only protection: A deductible of no less than $1,700

- Household protection: A deductible of no less than $3,400

- Out-of-pocket bills: For 2026, the out-of-pocket restrict for self-only protection is capped at $8,500, and for household protection, it’s capped at $17,000.

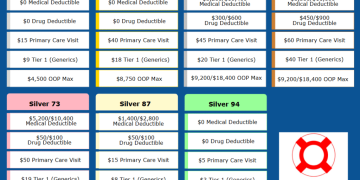

Supply: New HSA contribution limit

Medical Prices in Retirement: Planning for the Future

One of the essential causes to begin saving for healthcare bills now’s the rising price of medical care in retirement. Healthcare bills in retirement might be substantial, and with out planning, these prices can considerably pressure your funds.

Based on Constancy, a 65-year-old retiring in 2024 can count on to spend a mean of $165,000 on healthcare all through retirement. Moreover, this estimate doesn’t account for long-term care bills, which might considerably improve general healthcare prices.

A well being financial savings account (HSA) can assist offset these future bills. By contributing to an HSA now and investing for the long run, you possibly can construct a cushion to assist cowl the rising prices of medical care as you age. Moreover, the funds in your HSA are moveable, that means you possibly can take them with you while you change jobs or retire, providing you with flexibility as you transition into retirement.

Choosing the Proper Well being Plan for 2026

When selecting a well being plan, it’s essential to think about each your present healthcare wants and your long-term monetary targets. Listed below are some key elements to assist information your choice:

- Healthcare Wants: In case you or a member of the family has frequent medical bills or persistent situations, chances are you’ll need to take into account a plan with decrease deductibles, even when it means greater month-to-month premiums.

- Saving for the Future: In case you’re in good well being and may afford greater out-of-pocket prices, a high-deductible well being plan (HDHP) paired with an HSA might be a good way to save lots of for future medical bills, particularly in retirement. HSAs are moveable—you possibly can take the funds with you while you change jobs or retire, providing added flexibility.

- Tax Benefits: HSAs supply unmatched tax benefits. In case you’re targeted on maximizing your tax-free development, an HSA is a brilliant alternative. Nonetheless, you have to be sure that your chosen well being plan qualifies for HSA contributions. It have to be an HDHP plan (excessive deductible well being plan).

- Employer Contributions: Some employers supply contributions to your HSA. In case your employer presents this profit, it may allow you to attain the contribution restrict extra shortly.

- Value Concerns: Consider each the premium prices and out-of-pocket maximums of the HDHPs accessible to you. In 2026, the contribution restrict will increase, however the out-of-pocket maximums for HDHPs are additionally rising. Make sure the plan suits inside your finances for premiums, deductibles, and potential out-of-pocket prices.

Conclusion

The elevated contribution limits for HSAs in 2026 present extra alternatives for saving on healthcare prices, and deciding on the correct well being plan is essential to taking advantage of this profit. Furthermore, by evaluating your healthcare wants, tax benefits, and long-term financial savings potential, you possibly can select a plan that can allow you to construct a more healthy and financially safe future. The “Huge Lovely Invoice” may also enable use of higher entry to telehealth, will enable seniors who’re nonetheless working and enrolled in a bunch insurance coverage to proceed to contribute to the HSA, and can enable even fitness center memberships to be paid out of the HSA accounts.

Contact us at Solid Health Insurance Agency with questions if the HDHP plan be proper on your medical wants or run your quote.

[author_name]