Choosing the proper medical insurance plan on your workers is among the most essential choices you’ll make as a enterprise proprietor. Not solely is it a key think about worker retention and satisfaction, however it additionally displays your dedication to their well-being.

When you’re evaluating quotes for group medical insurance in Arizona, you would possibly discover that costs and plan options can range extensively and shortly get complicated. So how do you ensure you’re getting the most effective worth, with out sacrificing high quality care?

Listed here are sensible, expert-backed ideas that will help you examine group medical insurance quotes and choose the right policy for your business and your staff.

Outline Your Wants Earlier than Requesting Quotes

Earlier than gathering any quotes, take time to assess your company’s needs. Ask your self:

- What number of workers will likely be coated?

- Are they concentrated in Arizona, or unfold out throughout different states?

- What’s the age vary and basic well being profile of your staff?

- How a lot can your enterprise realistically contribute towards premiums?

Understanding your targets and workforce demographics will enable you to examine plans extra successfully and keep away from under- or over-insuring.

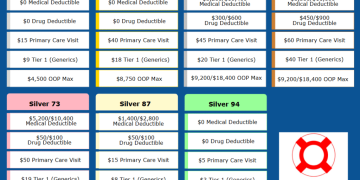

Examine the Whole Value, Not Simply the Month-to-month Premium

It’s tempting to choose the quote with the bottom month-to-month premium, however that’s not the whole picture. True affordability relies on what the plan really covers and the way a lot it shifts prices to your workers.

Look carefully at:

- Deductibles

- Copays and coinsurance

- Out-of-pocket maximums

- Prescription drug tiers

- Worker cost-sharing

A barely increased premium would possibly provide higher protection and decrease worker bills total, making it a better funding in recruitment and retention.

Perceive the Kind of Plan You’re Quoting (HMO vs. PPO vs. HDHP)

Totally different plan constructions provide completely different advantages and trade-offs. Right here’s a fast breakdown:

- HMO (Well being Upkeep Group): Decrease premiums, smaller supplier community, referrals required.

- PPO (Most popular Supplier Group): Larger premiums, extra flexibility with out-of-network protection, no referrals.

- HDHP (High Deductible Health Plan): Decrease premiums, increased deductibles, eligible for pairing with a Well being Financial savings Account (HSA).

Ensure you’re evaluating related plan sorts when reviewing quotes; in any other case, you would be taking a look at two completely completely different ranges of protection.

Ask What’s Included and What’s Not

Two quotes might have related premiums however vastly completely different protection. Don’t assume that important providers are included except clearly said.

Examine whether or not the plan consists of:

- Psychological well being providers and remedy

- Telemedicine and digital care

- Specialist visits and diagnostic testing

- Maternity and pediatric care

- Rehabilitation or persistent illness administration

Additionally verify whether or not imaginative and prescient, dental, or different ancillary advantages are included or supplied as separate choices.

Examine the Supplier Community

Arizona has a various healthcare panorama, however not each plan consists of each supplier. Some of the frequent frustrations workers face is discovering out their most well-liked medical doctors or hospitals are out of community.

Make certain to:

- Evaluate the supplier listing included with the quote

- Verify entry to main hospital methods in your space (e.g., Banner, HonorHealth, Dignity Well being)

- Contemplate distant staff—have they got entry to a robust community of their space?

If flexibility issues to your staff, a broader PPO community is perhaps price the additional value.

Evaluate Service Fame and Buyer Service

Not all insurance coverage carriers are created equal. When evaluating quotes, issue within the firm’s repute for service, claims processing, and assist.

Search for:

- On-line evaluations

- Supplier satisfaction rankings

- Assist instruments (like cell apps or on-line portals)

At J.C. Lewis Insurance coverage Companies, we solely work with respected carriers we belief to ship long-term worth to our shoppers.

Lean on an Unbiased Insurance coverage Dealer

Navigating quotes and plan comparisons might be time-consuming and, frankly, overwhelming. That’s the place working with an independent insurance broker makes all of the distinction.

As a dealer, we:

- Collect a number of quotes for you from prime carriers

- Break down the variations in plain language

- Assist match the most effective plan to your staff’s wants and your funds

- Deal with ongoing service and renewals

You get skilled steerage with out having to turn out to be an insurance coverage skilled your self.

Able to Be taught Extra?

Worker medical insurance is among the strongest instruments you need to assist your workforce and strengthen your enterprise. However discovering the most effective coverage isn’t about choosing the most affordable quote, it’s about understanding what you’re paying for and the way it helps the individuals who make your organization thrive.

At J.C. Lewis Insurance Services, we assist Arizona companies examine quotes, consider choices, and construct advantages packages that work for everybody. Name 707-978-2359 or go to https://jclis.com to get began with a customized, no-pressure session.

The publish Comparing Quotes: Tips for Finding the Best Business Policy appeared first on JC Lewis Insurance.

[author_name]

For the reason that the admin of this site is working, no uncertainty very quickly it will be renowned, due to its quality contents.

thor-darknet-link.cc

LeonBet macht Gl�cksspiel digital und unterhaltsam.

v1e06m

vod5tt

uxlb3k

5q51jj

kv20x5