If Congress doesn’t lengthen enhanced Market subsidies which have been serving to make protection extra reasonably priced since 2021, a whole bunch of 1000’s of Market enrollees with family incomes over 400% of the federal poverty stage will face the return of the so-called “subsidy cliff. as a result of subsidies ending abruptly if family earnings exceeds 400% of FPL.

The affect of the “subsidy cliff” would trigger dramatic will increase in medical health insurance premium expenditures. Notably arduous hit can be enrollees of their 50s and 60s, who – with out subsidies – may nicely face premiums that devour half or extra of their earnings. (Premiums are age-based; with out subsidies, an individual who’s 52 pays about twice as a lot as an individual who’s 21, and an individual who’s 64 pays thrice as a lot as an individual who’s 21).

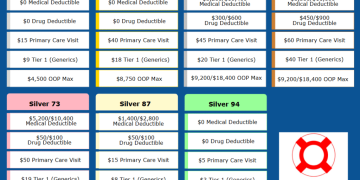

Right here’s what the affect may seem like if the “subsidy cliff” returns:

Many older Market patrons face drastic premium hikes

If the “subsidy cliff” returns to the medical health insurance Market in 2026, a 63-year-old couple in Charleston, West Virginia, incomes $85,000/12 months, pays greater than 15 occasions as a lot for the lowest-cost Gold plan, in contrast with what they paid in 2025.

In 2025, they pay about $300/month for the lowest-cost Gold plan, they usually even have entry to a zero-premium Bronze plan.

But when Congress doesn’t lengthen the subsidy enhancements that have been keeping coverage more affordable since 2021, this couple will lose their subsidy altogether.

- The Gold plan that at present prices them $300/month will price an estimated $4,713/month in 2026.

- And the Bronze plan they’ll at present get for $0/month will price an estimated $3,817/month.

In the event that they preserve the Gold plan, they’ll be spending two-thirds of their family earnings on medical health insurance.

And even the bottom premium Bronze plan – which they may get with no premium in any respect in 2025 – will price greater than half of their family earnings.

‘Subsidy cliff’ impacts households with incomes above 400% of federal poverty stage

That’s as a result of $85,000 for a family of two is 402% of the 2025 federal poverty stage (FPL). And the ACA has a so-called “cliff” the place Market subsidy eligibility ends abruptly if an enrollee’s family earnings is greater than 400% of the earlier 12 months’s FPL. That’s the way it labored from 2014 via 2020, when subsidies weren’t out there to those enrollees, no matter how costly their protection was.

The subsidy eligibility income limit was temporarily lifted from 2021 through 2025, as a result of American Rescue Plan (ARP) and Inflation Discount Act (IRA). However it should come again in 2026 except the ARP/IRA subsidy enhancements are prolonged by Congress. .

American Rescue Plan and Inflation Discount Act quickly get rid of ‘subsidy cliff’

Part 9661 of the ARP capped Market medical health insurance premiums (for the benchmark Silver plan) at not more than 8.5% of family earnings.

The 8.5% cap applies to folks with family incomes of 400% of the federal poverty stage or larger. For folks with decrease incomes, the percentage of income that has to be paid for the benchmark premium has been reduced across the board. These subsidy enhancements have been initially relevant for 2021 and 2022, however the Inflation Reduction Act extended them via 2025.

In case your family earnings is greater than 400% of FPL and the benchmark plan’s premium would already be not more than 8.5% of your earnings, you will not qualify for a premium subsidy (which means, the ARP/IRA did not change something about your state of affairs). That is extra more likely to be the case for youthful enrollees in areas of the nation the place medical health insurance is more cost effective than common.

But when the full-price price of the benchmark plan can be greater than 8.5% of your earnings, you’ve got been eligible for a premium subsidy between 2021 and 2025. (This assumes you meet the remainder of the eligibility necessities, which means that you simply’re lawfully current within the U.S. and never eligible for Medicaid, premium-free Medicare Half A, or employer-sponsored protection that is thought-about reasonably priced and supplies minimal worth).

So for some folks, particularly older enrollees in areas of the nation the place medical health insurance is especially pricey, even these with earnings nicely above 400% of FPL are receiving some type of subsidy. But when Congress doesn’t lengthen the ARP subsidy enhancement provisions once more, individuals who earn greater than 400% of FPL will not qualify for a subsidy in 2026 – regardless of how costly their medical health insurance will probably be.

Why it’s known as a ‘cliff’

If the “subsidy cliff” returns, a number of hundred {dollars} in additional annual earnings may translate to the lack of 1000’s of {dollars} monthly in subsidies, if it pushes you over the 400% FPL threshold. And as we illustrated above, some enrollees will discover that even essentially the most cheap well being plan may have premiums that quantity to greater than half their annual earnings. For many households, that’s merely unaffordable.

It’s known as a cliff as a result of there’s a pointy and sudden spike in medical health insurance premiums when subsidies finish abruptly at 400% of FPL. From 2021 via 2025, subsidies have as an alternative phased out slowly as earnings elevated. However that can not be the case in 2026 if subsidies return to solely being out there to enrollees with family earnings as much as 400% of FPL.

Let’s take one other take a look at the 63-year-old West Virginia couple described above, however let’s assume their earnings in 2026 will probably be $84,500, as an alternative of $85,000. That places them simply over 399% of the 2025 FPL, which means they are going to nonetheless qualify for a premium subsidy in 2026.

In that case, their after-subsidy premiums for the benchmark Silver plan will probably be capped at a little less than 10% of their household income. That may imply the benchmark plan will price them somewhat greater than $700/month in 2026. They’ll be capable of apply their subsidy to any metal-level plan, which means they’ll be capable of get the lowest-cost Bronze or Gold plan for even decrease premiums.

But when their earnings goes above $84,600 (400% of the 2025 FPL), they are going to lose their subsidy altogether if Congress doesn’t lengthen the subsidy enhancements.

Areas with larger common premiums will probably be hit hardest by the ‘cliff’

We used West Virginia as the instance right here as a result of particular person/household medical health insurance premiums in West Virginia are a lot larger than the nationwide common.

So let’s additionally think about Idaho, the place 2025 premiums are a lot decrease than the nationwide common. We’ll assume we’ve got the identical 63-year-old couple, incomes $85,000, however now they dwell in Boise as an alternative of Charleston.

- In 2025, the lowest-cost Bronze plan prices them lower than $2/month after subsidies. In 2026, that plan will price them $1,527/month if the “subsidy cliff” is allowed to return.

- In 2025, the lowest-cost Gold plan prices $712/month. That may soar to $2,354/month in 2026 if the “subsidy cliff” comes again.

Whereas these quantities aren’t as excessive because the West Virginia instance (as a result of medical health insurance is decrease in Idaho), this couple will nonetheless need to pay greater than a fifth of their family earnings for the lowest-cost plan, if the “subsidy cliff” is allowed to return.

Louise Norris is a person medical health insurance dealer who has been writing about medical health insurance and well being reform since 2006. She has written a whole bunch of opinions and academic items concerning the Inexpensive Care Act for healthinsurance.org.

[author_name]

New users can now get rewarded instantly with the best https://www.milliescentedrocks.com/board/board_topic/2189097/7326625.htm. Register, deposit, and experience high-odds betting with guaranteed bonuses.