Open enrollment for 2023 ACA-compliant particular person/household well being protection is underway – beginning Nov. 1, 2022 and persevering with by means of Jan. 15, 2023 in most states.

Tens of millions of People will enroll or renew their protection for 2023 throughout open enrollment. Some have been shopping for their very own medical insurance for years, whereas others are pretty new to the method. And a few are at present uninsured or have been coated by plans that aren’t ACA-compliant – such asa healthcare sharing ministry plan or short-term health insurance.

This text offers you an summary of what to anticipate in the course of the open enrollment interval. For much more details about open enrollment, take a look at our comprehensive guide to open enrollment.

ACA open enrollment will look largely acquainted this fall

Typically, this 12 months’s open enrollment interval can be pretty just like final 12 months’s, however with some adjustments that we’ll handle in additional element beneath:

- Every state will proceed to make use of the identical exchange/marketplace platform it used final fall (HealthCare.gov in 33 states, and a state-run platform in DC and the other 17 states). And most states will proceed to make use of the identical enrollment schedule they used final 12 months.

- The Inflation Reduction Act has prolonged the American Rescue Plan’s subsidy enhancements by means of 2025, so the subsidy guidelines that have been in impact for 2022 will proceed to be in impact for 2023. (There’s no “subsidy cliff” and the proportion of earnings that you must pay for the benchmark plan is lower than it used to be.)

- As a result of the subsidy enhancements have been prolonged, the record-high enrollment we saw this year is likely to continue, and the improved affordability that the American Rescue Plan created will even proceed. However that doesn’t imply your premium will keep the identical — extra on this beneath.

- Brokers and Navigators will proceed to offer help with enrollment. And Navigator funding is higher than ever before, in an effort to extend outreach and enrollment help.

- The insurers providing well being plans by means of the exchanges (and out of doors the exchanges) will usually be the identical insurers that supplied plans for 2022. However there are a number of insurers becoming a member of the alternate or increasing their protection space for 2023, and a few insurers which can be shrinking their protection areas or leaving the market altogether.

- The IRS has finalized a repair for the “household glitch” which is able to make some households newly eligible for premium subsidies within the market.

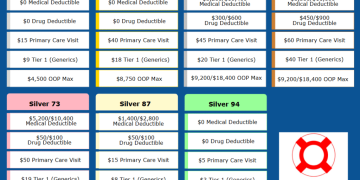

- Standardized plans are returning to HealthCare.gov. Standardized plans have been non-obligatory for insurers to supply in 2017 and 2018, however the federal authorities now not created standardized plan designs as of 2019. For 2023, standardized plans are as soon as once more out there by means of HealthCare.gov (they’re labeled with a inexperienced tag that claims “straightforward pricing”). And so they’re now not non-obligatory; insurers are required to supply them.

What are the open enrollment deadlines for 2023 plans?

By now, most individuals are accustomed to the truth that particular person/household well being protection is now not out there for buy year-round, and as an alternative makes use of open enrollment and particular enrollment intervals, just like these used for employer-sponsored plans. The identical open enrollment schedules apply to plans bought by means of the alternate/market and to plans bought from insurance coverage firms by means of non-public channels (ie, “off-exchange”).

Open enrollment begins November 1, and in practically each state, it’s going to proceed by means of no less than January 15. (Be aware that Idaho is an exception: Open enrollment in Idaho begins and ends earlier, operating from October 15 to December 15. Idaho is the one state the place open enrollment for 2023 protection will finish earlier than the beginning of the 12 months.)

So in most states, the enrollment schedule will comply with the identical timeframe that was used final 12 months. And in most states, you’ll must enroll by December 15 with a view to have your protection take impact on January 1. Enrolling after December 15 will usually end in a February 1 efficient date.

One caveat to remember: In case your present well being plan is terminating on the finish of 2022 and never out there for renewal, you can select a new plan as late as December 31 and nonetheless have it take impact January 1.

Though open enrollment continues by means of no less than mid-January in most states, it’s generally in your best interest to finalize your plan selection in time to have the coverage in force on January 1.

In most states, which means you’ll must enroll or make a plan change by December 15. By way of the efficient date of your protection, there’s no distinction between enrolling on November 1 versus December 15. However ready till the final minute would possibly really feel a bit extra aggravating, and also you may need bother discovering an enrollment assister who might help you at that time. You don’t have to be the primary individual in line, however it’s good to present your self a little bit of wiggle room in case you run into glitches with the enrollment course of or discover that you just’d like help with some or all of it.

Relaxation assured, nonetheless, that open enrollment continues till no less than mid-January in most states. So if there’s no approach so that you can get signed up within the earlier a part of the enrollment window, you can probably full the method after the beginning of the 12 months and have protection in impact as of February.

Insurers coming into and leaving particular person and household markets

As is at all times the case, there can be some fluctuation by way of which insurers supply particular person/household well being protection for 2023. For the final a number of years, the overall development has been towards elevated insurer participation within the exchanges. Right here’s extra about what we noticed in 2020, 2021, and 2022.)

That development is continuous in 2023, with new insurers becoming a member of (or rejoining) the exchanges in lots of states. However there are additionally some important insurer exits that current enrollees want to concentrate on.

A number of insurers are becoming a member of exchanges within the following states for 2023:

- Ambetter/Celtic (Alabama)

- Cigna (Texas, Indiana, and South Carolina)

- Ascension Personalised Care (Tennessee, and Texas)

- Aetna (Delaware, California, Illinois, New Jersey)

- UnitedHealthcare (Kansas, Mississippi, Missouri, Ohio)

- AmeriHealth (Delaware and Florida)

- Taro Well being (Maine)

- Blue Cross Blue Shield of Nebraska (Nebraska)

- Moda Well being (Idaho)

- Luke’s Well being Plan (Idaho)

- CareSource (North Carolina)

- Imperial Insurance coverage Firms (Texas and Arizona)

- Choose Well being of South Carolina (South Carolina)

- Wellmark Blue Cross and Blue Defend of South Dakota (South Dakota)

However there are additionally some insurers exiting the marketplaces in a number of states, together with:

- Oscar Health (Exiting Arkansas and Colorado, however remaining in nine other states.)

- Bright HealthCare (Exiting the person/household market in all 17 states the place they at present supply these plans, leading to roughly 1,000,000 alternate enrollees needing to pick out new plans; beforehand, Vibrant has deliberate to exit six states and stay in 11 other states, however that modified as of October 2022, once they announced a full exit from the person market. Anybody with a person/household plan from Vibrant Well being — in any state — might want to swap to a unique insurer for 2023. The plans are branded as Vibrant HealthCare in most states, however True Health New Mexico is also Bright HealthCare and won’t be out there for 2023.)

- WPS Well being Plan Inc. is exiting the on-exchange market in Wisconsin, however will proceed to supply off-exchange plans.

- Friday Well being Plans is exiting the individual/family market in Texas and New Mexico, however will proceed to supply protection in 5 different states.

Even in states the place the collaborating 2023 insurers would be the similar ones that supplied protection in 2022, there could also be service space adjustments in some states. This might end in an insurer’s plans turning into newly out there in some areas, or now not out there in some areas.

Final 12 months, we detailed the things that people need to keep in mind if a brand new insurer is becoming a member of the alternate. All of these factors are nonetheless relevant for folks in areas the place new insurers will supply plans in 2023.

The principle takeaway level is that it’s necessary to actively evaluate your out there plan choices, versus simply letting your existing plan auto-renew. One of many new plans (or one other current plan) would possibly find yourself being a greater match in your wants. However it’s additionally doable that the benchmark plan’s pricing may change considerably, affecting the quantity of your subsidy. If the worth of your present plan shoots up, a comparable plan will doubtless be out there for about what you paid this 12 months (in case your earnings and household dimension haven’t modified).

It’s additionally price holding in thoughts that the insurer’s estimate of what you’re prone to pay within the coming 12 months, offered in a letter this fall, could also be inaccurate – once more, due to a shift in its pricing relationship to this 12 months’s benchmark plan. You’ll get a separate letter from the alternate with particulars about your subsidy quantity for 2023 and the quantity you’ll pay should you let your present plan renew. However it’s additionally important to log onto the alternate, replace your data, and be taught what your present plan and different plans will price in 2023.

Who can be helped by the ‘household glitch repair’?

Ever since ACA-compliant plans debuted within the fall of 2013, folks have been ineligible for subsidies in the event that they’re eligible for an employer-sponsored well being plan that’s thought-about inexpensive. And the affordability willpower has at all times been based mostly on the price of employee-only protection, with out taking into consideration the price so as to add relations to the plan. But when the employer-sponsored plan was deemed inexpensive, the whole household was ineligible for subsidies within the market, so long as they have been eligible to be added to the employer’s plan. This is called the “family glitch,” and it has put inexpensive well being protection out of attain for hundreds of thousands of People through the years.

Earlier this 12 months, the IRS proposed a long-awaited repair for the household glitch, which was finalized a couple of weeks previous to the beginning of open enrollment. Below the brand new guidelines, {the marketplace} will do two separate affordability determinations when a family has access to an employer’s plan: one for the worker, and one for complete household protection. If the worker’s protection is taken into account inexpensive however the household’s will not be, the remainder of the household will doubtlessly be eligible for subsidies within the market.

Some households will nonetheless discover that they like to make use of the employer’s plan, regardless of the price. However some will discover that it’s useful to place some or the entire relations on a market plan, even whereas the worker continues to have employer-sponsored protection.

The principle level to remember right here is that it’s necessary to double-check your market choices throughout open enrollment – even should you regarded prior to now and weren’t eligible for subsidies attributable to a proposal of employer-sponsored protection.

How are ACA premiums altering for 2023?

The one strategy to know for certain what your 2023 premium can be is to observe for correspondence out of your insurer and alternate. They’ll notify you this fall about adjustments to your plan for 2023, together with the brand new premium (and subsidy quantity should you’re subsidy-eligible; most individuals are).

There’s a whole lot of variation from one plan to a different by way of pricing adjustments, and your internet (after-subsidy) premium will even rely on how a lot your subsidy adjustments for 2023. However right here’s a basic overview of what to remember:

- Throughout a lot of the states, the general weighted common charge change for 2023 quantities to a 6.2% increase, in line with ACA Signups. Closing charges have usually been a bit decrease than the insurers proposed. (That is partly as a result of Inflation Reduction Act — which was enacted after insurers filed their charges and which is able to end in barely smaller-than-proposed charge will increase for some plans — and partly attributable to state regulators’ actions to cut back charges in the course of the evaluation course of).

- That’s somewhat bigger than the general common charge will increase we’ve seen for the previous few years (3.5% for 2022, less than 1% for 2021, and a slight decrease for 2020). However an total common charge change solely provides us an enormous image; it doesn’t let you know how a lot your personal plan’s premium will change or how a lot your internet premium will change, and it additionally doesn’t account for the brand new plans that can be supplied for 2023.

- Throughout all states that use HealthCare.gov, the common benchmark (second-lowest-cost Silver plan) premium is increasing by 4% for 2023. in your space goes up, subsidy quantities will even go up. Conversely, if the benchmark premium goes down, subsidy quantities will even go down. That is impartial of what your personal plan’s value does. It may be doable, for instance, in your plan’s premium to go up whereas the benchmark premium goes down (maybe as a result of a brand new insurer takes over the benchmark spot), leading to a extra important improve within the precise quantity you pay every month. That is why it’s so necessary to pay shut consideration to the data you obtain out of your insurer and the alternate, and to rigorously contemplate all your choices throughout open enrollment.

As open enrollment attracts nearer, we’ll proceed to replace our open enrollment guide and our overview of each state’s marketplace.

You can begin doing all your plan procuring analysis now

If you have already got market protection, preserve a watch out for correspondence from {the marketplace} and your insurer. When you at present have off-exchange protection, make sure you verify your eligibility for subsidies within the market; you would possibly discover you could get a a lot better worth by switching to a plan supplied by means of {the marketplace}.

And should you’re at present uninsured or enrolled in non-ACA-compliant protection, you’ll undoubtedly need to have a look at the plan choices which can be out there to you throughout open enrollment, and verify your eligibility for subsidies. You could be stunned to see how inexpensive your protection could be. The average enrollee is paying $133/month this 12 months, and greater than 1 / 4 of enrollees are paying lower than $10/month. Though particular plan costs change from one 12 months to the following, this similar total stage of affordability will proceed in 2023.

Louise Norris is a person medical insurance dealer who has been writing about medical insurance and well being reform since 2006. She has written dozens of opinions and academic items in regards to the Inexpensive Care Act for healthinsurance.org. Her state well being alternate updates are usually cited by media who cowl well being reform and by different medical insurance consultants.

[author_name]