All of us spend our lives in one of the best ways, and each section goes easily as a result of we’ve pre-planned it to perfection. Cremation insurance coverage for seniors is a sensible approach to make sure that your remaining preparations usually are not solely taken care of but additionally present peace of thoughts each emotionally and financially.

For a lot of seniors, securing the best cremation insurance coverage coverage is about offering a considerate present to their family members – a gesture of foresight and care. It ensures that the monetary facets of your farewell usually are not a supply of stress throughout an already emotional time.

This information will enable you perceive cremation insurance coverage, together with what it covers, how a lot it prices, and what options there are. It is going to additionally clarify why many seniors buy cremation insurance coverage as a considerate present for their loved ones.

By the tip of this information, you’ll have the information you’ll want to make knowledgeable choices about cremation insurance coverage and provides your self peace of thoughts.

What’s Cremation Insurance coverage for Seniors?

Cremation insurance for seniors is a specialised sort of insurance coverage coverage designed to offer monetary protection for the bills related to cremation after the insured particular person’s passing. It’s an integral part of end-of-life planning, particularly tailor-made to alleviate the monetary burden on family members throughout a difficult time.

Seniors usually go for cremation insurance coverage to make sure that their remaining needs are revered and to spare their households from the monetary tasks that include cremation. The sort of insurance coverage is a type of remaining expense insurance coverage, which focuses on masking the prices related to end-of-life preparations.

What Does Cremation Insurance coverage for Seniors Cowl?

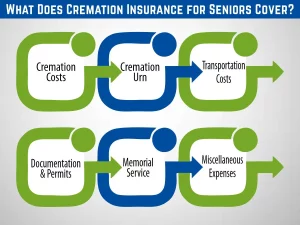

Cremation insurance for seniors is designed to cowl a spread of bills related to the cremation course of. Whereas the particular protection can differ relying on the insurance coverage supplier and coverage phrases, listed here are the everyday bills that cremation insurance coverage for seniors might cowl:

- Cremation Prices: This contains the bills associated to the cremation service itself. It covers the price of utilizing a crematory facility and the precise cremation course of.

- Cremation Urn: Many insurance policies embody protection for the acquisition of a cremation urn, which is used to carry the cremated stays.

- Transportation Prices: The coverage might cowl the bills related to transporting the deceased to the crematory facility.

- Documentation and Permits: Cremation requires varied permits and documentation. Cremation insurance coverage usually covers these administrative prices.

- Memorial Service: Some insurance policies might present protection for a memorial service or a gathering to recollect the deceased.

- Miscellaneous Bills: There may be varied further prices that come up in the course of the cremation course of, and these may additionally be included within the protection.

It’s vital to fastidiously overview the phrases and circumstances of your particular cremation insurance coverage coverage to know precisely what is roofed. Insurance policies can differ, and a few might provide extra complete protection than others.

What’s the Least expensive Type of Cremation Insurance coverage for Seniors?

The most cost effective type of cremation insurance coverage for seniors usually comes within the form of time period life insurance coverage insurance policies with a burial rider. Time period life insurance coverage is usually extra reasonably priced than complete life insurance coverage and gives a solution to particularly tackle remaining expense wants, comparable to cremation prices.

Right here’s why time period life insurance with a burial rider is usually thought-about probably the most cost-effective selection:

- Affordability: Time period life insurance coverage usually has decrease premiums in comparison with complete life insurance coverage, making it a lovely possibility for seniors trying to handle prices.

- Customizable Riders: Time period life insurance policies can help you customise protection with riders. Including a burial rider ensures {that a} portion of the coverage’s dying profit is allotted to cowl cremation or burial bills.

- Enough Protection: Time period insurance policies may be tailor-made to offer protection for the particular quantity wanted to cowl cremation prices, so that you’re not paying for extra protection than obligatory.

Whereas time period life insurance coverage with a burial rider is usually the most cost effective possibility, it’s important to contemplate that time period insurance policies have a restricted period (usually 10, 15, 20, or 30 years). If the insured particular person outlives the coverage time period, protection expires, and no profit is paid. Nonetheless, in case your main concern is managing the quick value of cremation, this is a superb selection for cost-effective protection.

What’s the Most Costly Cremation Insurance coverage for Seniors?

The costliest cremation insurance coverage for seniors is often complete life insurance coverage with a specialised cremation insurance coverage rider. Entire-life insurance policies include greater premiums, however they provide a lifetime of protection and construct money worth over time. Including a cremation insurance coverage rider to an entire life coverage can additional enhance the associated fee.

How Does Pay as you go Cremation Insurance coverage Work?

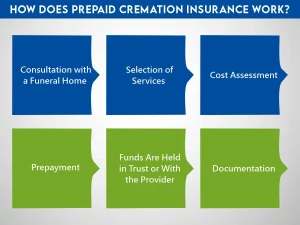

Pay as you go cremation insurance coverage, also referred to as pre-need cremation insurance coverage, is a monetary association that permits people to pre-arrange and pre-pay for his or her cremation companies. The sort of insurance coverage helps make sure that your remaining needs are carried out and that the related bills are coated when the time comes.

Right here’s how pay as you go cremation insurance coverage works:

1- Session with a Funeral Dwelling or Supplier

The method usually begins with a session with a funeral house, crematory, or a pre-need supplier. You talk about your particular needs and plan the cremation service based on your preferences.

2- Collection of Providers

Through the session, you’ll choose the companies you need, together with the kind of cremation, urn, memorial service, and some other particulars you’d prefer to customise.

3- Price Evaluation

The funeral house or supplier will calculate the whole value of the chosen companies and offer you a breakdown of bills.

4- Prepayment

When you’ve agreed on the companies and prices, you make a pre-payment to cowl these bills. This fee may be made in a lump sum or by installments, relying on the supplier’s insurance policies.

5- Funds Are Held in Belief or With the Supplier

The pay as you go funds are usually held in a belief account or with the pre-need supplier. This ensures that the cash is safeguarded till it’s wanted.

6- Documentation

You’ll obtain documentation outlining the pre-arranged companies, prices, and different related particulars. This documentation is usually shared with relations, making certain that your needs are recognized and may be simply executed when the time comes.

How A lot Does Cremation Insurance coverage for Seniors Price?

Cremation insurance coverage for seniors can differ in value primarily based on a number of components, together with age, well being, protection quantity, and the kind of coverage. To supply a common concept of the potential prices, here’s a pattern desk outlining estimated month-to-month premium ranges for various protection quantities and age teams.

| Protection Quantity | 50-55 Years Outdated | 60-65 Years Outdated | 70-75 Years Outdated |

| $5,000 | $15 – $30 | $25 – $45 | $40 – $70 |

| $10,000 | $30 – $60 | $50 – $90 | $80 – $140 |

| $15,000 | $45 – $90 | $75 – $135 | $120 – $210 |

| $20,000 | $60 – $120 | $100 – $180 | $160 – $280 |

Please be aware that the precise value might differ relying in your particular circumstances, the insurance coverage supplier you select, and the state you reside in. Moreover, premiums might differ primarily based on particular person well being assessments and underwriting.

It’s essential to request customized quotes from insurance coverage suppliers to acquire correct pricing data. This lets you examine insurance policies and select the most effective match in your wants and finances.

Easy methods to Discover the Greatest Cremation Insurance coverage for Seniors?

Discovering the most effective cremation insurance coverage for seniors includes cautious consideration of varied components to make sure that the coverage aligns along with your particular wants and circumstances. Right here’s a step-by-step information that will help you discover probably the most appropriate cremation insurance coverage:

Begin by figuring out your particular necessities. Think about components like the quantity of protection you want, any specific cremation preferences, and your finances.

-

Analysis Insurance coverage Suppliers

Start by researching respected insurance coverage corporations that supply cremation insurance coverage for seniors. Search for suppliers with a historical past of dependable service and optimistic buyer evaluations.

Request quotes from a number of insurance coverage suppliers. Evaluate the insurance policies they provide, being attentive to protection particulars, premiums, and any further riders or advantages.

-

Think about Extra Riders

Consider whether or not you want any further riders to customise your protection. Widespread riders embody burial riders, unintentional dying riders, and waiver of premium riders.

-

Examine Monetary Stability

Confirm the monetary stability of the insurance coverage firm. Scores from businesses like A.M. Greatest and Commonplace & Poor’s can provide perception into the corporate’s monetary well being and skill to satisfy claims.

Search for suggestions from different policyholders and clients. Critiques and testimonials can present insights into the standard of service and the claims course of.

Consider whether or not pay as you go cremation plans supplied by native funeral properties or crematories is likely to be extra appropriate in your wants.

Don’t accept the primary quote you obtain. Request quotes from a number of suppliers to make sure you get probably the most aggressive provide.

Discovering the most effective cremation insurance coverage for seniors includes a mix of analysis, private evaluation, and knowledgeable recommendation. Take your time, take into account your choices, and make an knowledgeable choice that aligns along with your monetary targets and end-of-life preferences.

Does Burial Cowl Cremation Insurance coverage?

Burial insurance coverage and cremation insurance coverage are related in that they each cowl end-of-life bills. Nonetheless, they aren’t the identical. Whereas burial insurance coverage is particularly designed for conventional burial bills, it could actually usually be used for cremation prices as nicely. The important thing distinction is that cremation insurance coverage is designed with cremation in thoughts, whereas burial insurance coverage may additionally cowl casket and plot bills.

Remaining Ideas

In conclusion, cremation insurance coverage for seniors is a vital monetary planning instrument, offering peace of thoughts for people and their family members throughout a difficult time. By understanding the protection choices, prices, and different options accessible, you may make an knowledgeable choice that fits your particular wants and circumstances.

Incessantly Requested Questions (FAQs)

1- Is cremation insurance coverage just for seniors?

Cremation insurance coverage is designed for seniors, nevertheless it can be bought by people of any age. Nonetheless, it’s extra generally related to seniors as a result of its concentrate on end-of-life planning.

2- Can burial insurance coverage be used to cowl cremation prices?

Sure, burial insurance can usually be used to cowl cremation prices, as they each serve the aim of masking end-of-life bills. The important thing distinction is that cremation insurance coverage is particularly designed with cremation in thoughts.

3- Is cremation insurance coverage obligatory if I have already got life insurance coverage?

Cremation insurance coverage is usually a useful addition to conventional life insurance coverage, because it ensures {that a} particular portion of your protection is allotted to cowl cremation bills. It offers focused monetary assist in your end-of-life needs.