Bonnie and Clyde, Ma Barker, Child Face Nelson and Willie Sutton robbed banks. When requested by a journalist requested why he did, Sutton famously replied “as a result of that’s the place the cash is.” If banks’ $3.1 trillion in money and invested assets attracts criminals to steal from banks, the insurance coverage trade’s $10 trillion in property arguably tempts fraudsters but extra. And it does.

Whereas banks’ annual losses from fraud are on the order of $2.7 billion, insurance coverage fraud measures a staggering $308.6 billion yearly. The FBI, which prosecutes important insurance coverage fraud circumstances, affirms the insurance coverage trade’s large dimension “contributes considerably to the price of insurance coverage fraud by offering extra alternatives and greater incentives for committing unlawful actions.” And from the fraudster’s perspective, insurance coverage fraud is against the law not requiring a gun, a masks or a getaway automotive. In an period of congressional hearings on cut back the price of insurance coverage for customers, one resolution is to assault insurance coverage fraud. Insurers’ fraud-related losses are handed onto all policyholders. If insurance coverage fraud have been worn out premiums could be 10 p.c decrease.

Insurance coverage fraud is the second-largest class of white-collar crime, following tax evasion. Insurers’ large hemorrhaging from fraud makes theft in different industries pale by comparability. Retailer shrink (theft) charge is 1.6 p.c. Wholesaler/stock shrink charge is estimated at 4 p.c.

Insurance coverage fraudsters might justify dishonest an insurance coverage firm as a result of it’s regarded as a victimless crime. In a current survey of attitudes surrounding insurance coverage fraud, nearly 9 p.c of respondents justified insurance coverage fraud as not being improper or felony primarily based on their perception that “insurance coverage corporations rip individuals off, so it’s honest” and “I pay them sufficient, it’s my cash I’m getting again.” The survey revealed a excessive share of respondents (28.6% p.c) discovering insurance coverage fraud “not an actual crime” (8.5 p.c) or constituted a “enterprise apply with no actual sufferer” (20.1 p.c).

The Many Flavors of Insurance coverage Fraud

Insurance coverage fraud is available in many varieties and sizes. It ranges from registering vehicles in a state aside from the state of ones residence as a result of charges and insurance coverage there can “save” a whole lot of {dollars}, to a not too long ago uncovered scheme which scammed Medicare $2 billion.

A few of the primary kinds of insurance coverage fraud, in reducing order of fraud quantity, are:

| Insurance coverage Fraud Class | Description or Instance | Estimated Annual Fraud Quantity |

| Life Insurance coverage | Failure to report medical situation, shopping for a life insurance coverage coverage on another person’s life and murdering them, faking dying | $74.7 billion |

| Medicaid and Medicare | Offering pointless companies | $68.7 billion |

| Property & Casualty | Staged accidents, arson | $45.0 billion |

| Healthcare | Suppliers billing for companies not rendered | $36.3 billion |

| Premium Avoidance | Misclassification of workers or underreporting payroll | $35.1 billion |

| Staff’ Compensation | Employee claiming to have been injured on the job, however was not | $34.0 billion |

| Incapacity | Claiming to be on incapacity with no mobility whereas coaching for a 10k footrace not for the wheelchair-bound | $7.4 billion |

| Auto Theft | Perpetrated solo or operated as a revenue heart by felony gangs | $7.4 billion |

| Whole | $308.6 billion |

(Information supply: The Influence of Insurance coverage Fraud on the U.S. Economic system. Coalition In opposition to Insurance coverage Fraud. 2022. https://insurancefraud.org/wp-content/uploads/The-Impact-of-Insurance-Fraud-on-the-U.S.-Economy-Report-2022-8.26.2022.pdf)

Troubling Generational Developments

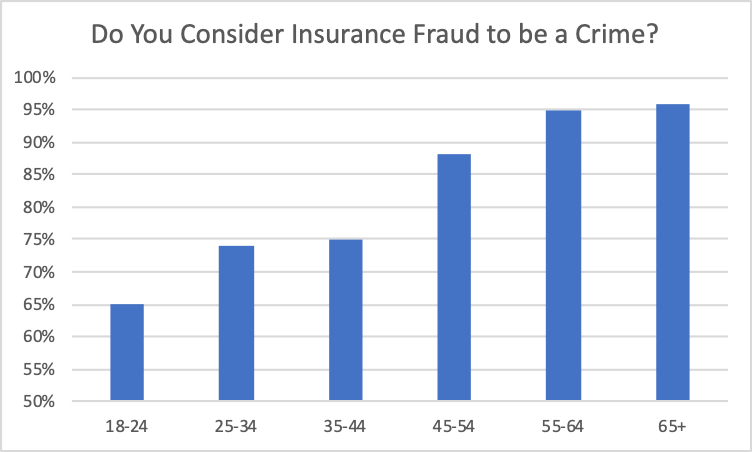

Whether or not somebody considers insurance coverage fraud against the law or not relies upon to a point on their age. Within the report presenting findings of the “Who Me?” research, respondents 45 and older have been rather more susceptible to think about insurance coverage fraud against the law. For the youngest respondents, aged 18 to 24, just below 65 p.c did, whereas 96 p.c of respondents 65 and older did.

(Information Supply: Who Me? Who Commits Insurance coverage Fraud and Why? Coalition In opposition to Insurance coverage Fraud and Verisk. 2023. Used with permission. https://insurancefraud.org/wp-content/uploads/WHO_ME_STUDY_REPORT.pdf)

The “Who Me?” survey additionally discovered respondents underneath the age of 45 reporting a considerably larger degree of dishonesty than these a era older. The under-45 respondents have been discovered to be rather more vulnerable to “Undoubtedly … Submit a Declare for a Car Brought about in a Prior Automotive Accident,” to submit a declare for a owners or insurance coverage coverage with harm from an earlier occasion, and would “undoubtedly would assist a medical supplier invoice an insurance coverage firm for remedy I didn’t obtain.”

Because the older era ages out, insurance coverage corporations needs to be involved they are going to more and more be coping with respondents self-reporting as having fewer scruples about committing insurance coverage fraud

Tales from the Darkish Aspect

A few of the most chilling examples of insurance coverage fraud are grisly affairs revealing the darkest of humanity’s darkish aspect:

- John Gilbert Graham positioned a time-release bomb on a aircraft during which his mom was touring, for the life insurance coverage cost. The bomb exploded. Along with Graham’s mom all 43 different passengers and crew perished.

- Utah doctor Farid Fata administered chemotherapy to a whole lot of ladies who didn’t have most cancers. Fata submitted $34 million in fraudulent claims to Medicare and personal insurance coverage corporations.

- Ali Elmezayen staged a freak automotive accident which took the lives of his two autistic kids and almost drowned his spouse. He collected a $260,000 insurance coverage payout, however his crime was found. He was sentenced to 212 years in jail.

- A Chicago federal grand jury charged 23 defendants with taking part in a fraud scheme swindling $26 million from ten life insurers. The scheme featured submission of fraudulent purposes to acquire insurance policies, and misrepresenting the identification of the deceased.

There are millions of different equally horrific insurance coverage fraud tales. The annual Soiled Dozen Corridor of Disgrace report describes among the most egregious, and contributes to an understanding of how far fraudsters will go to cheat insurance coverage corporations.

How is Insurance coverage Fraud Addressed?

There are a number of organizations combatting insurance coverage fraud. In 42 states the insurance coverage division has a fraud investigation unit. In different states, resembling Colorado, insurance coverage fraud investigations are the accountability of the Legal professional Common’s workplace. The fraud items are staffed with anti-fraud and felony investigators working with federal, state, and native legislation enforcement officers to prosecute insurance coverage fraud. When a number of states are concerned within the fraud or if it’s a massive case, the FBI might pursue the case on a felony foundation. Insurance coverage corporations even have inner Particular Investigation Items (SIUs).

New Developments – Synthetic Intelligence

Enhancements in predictive modeling and the introduction of synthetic intelligence (AI) have strengthened insurers skills to establish, and in the end examine, submitted claims that could be fraudulent. On the similar time, nonetheless, AI can be getting used as a weapon to penetrate insurers’ fraud detection methods. Methods getting used embody AI-created pretend images of automobiles of a selected make and mannequin exhibiting harm that’s not actual, however used to extract a claims cost. Some insurers are now not accepting pictures as a result of they might be doctored, and are returning to adjustors bodily visiting the allegedly broken automotive. A nefarious life insurance coverage rip-off consists of AI-enabled manipulation of ones voice so {that a} felony third occasion will get previous insurers’ voice recognition expertise, and initiates a coverage being surrendered to a non-policyholder, non-beneficiary. Plainly for each extra layer of safety insurers introduce, the criminals are maintaining, if not forging forward.

Motion Required

Insurers must strengthen their inoculation towards the insurance coverage fraud germ. They need to educate youthful generations to know that insurance coverage fraud is certainly against the law, regardless in the event that they assume in any other case. In right now’s populist political setting massive enterprise, together with insurers, is just too typically singled out as accountable for no matter ills there could also be. As we now have argued elsewhere, the mixed impact of plaintiff legal professional corporations vilifying insurers, and zealous shopper advocates denouncing insurers, is to offer the trade a black eye. What’s extra, youthful generations’ picture of the insurance coverage trade is coloured by billboard attorneys promising to stay it to the insurance coverage firm.

Insurers must also be part of forces with different events battling insurance coverage fraud – state insurance coverage division fraud items, native and federal legislation enforcement, and organizations such because the Coalition In opposition to Insurance coverage Fraud and the Nationwide Insurance coverage Crime Bureau. As insurance coverage fraudsters exploit new applied sciences, and because the youthful generations with adverse views on insurance coverage change into policyholders, the struggle might get more durable, but it surely have to be fought if combatting insurance coverage crime can ever be a driver of decrease insurance coverage charges.

Subjects

Fraud

Enthusiastic about Fraud?

Get computerized alerts for this subject.