The inventory market suffered its longest dropping streak since January as a handful of huge techs bought off — regardless of a slide in bond yields.

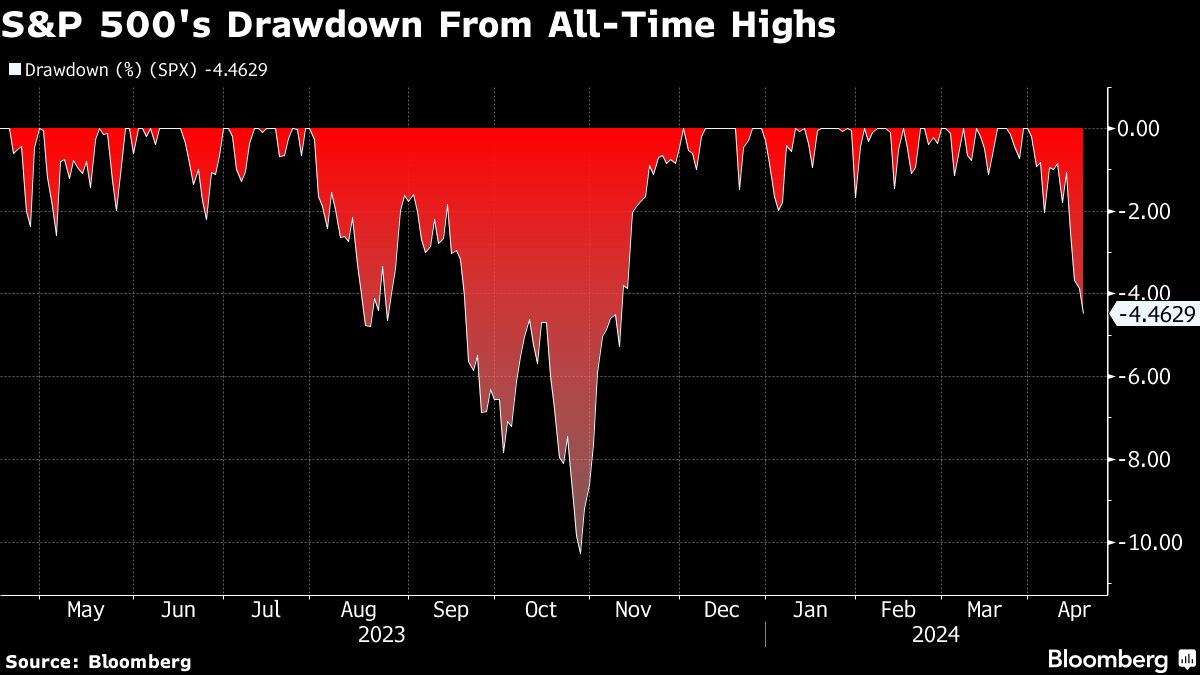

Equities fell for a fourth straight day, with the S&P 500 extending a drop from its all-time excessive to greater than 4%. Chipmakers bore the brunt of the promoting after ASML Holding NV’s orders tumbled.

Nvidia Corp. led losses in megacaps. A tug of conflict between bulls and bears unfolded amid the expiration of VIX choices — with Wall Avenue’s favourite volatility gauge whipsawing.

After a ten% inventory rally within the first quarter — the strongest begin to a yr since 2019 — traders have been more and more skeptical about how a lot additional the market may go over the close to time period, even accounting for the continued energy within the economic system.

“The mix of geopolitical uncertainty, rising rates of interest, Fed hawkishness, and inflation frustration have mixed to place bears briefly in cost,” mentioned Mark Hackett at Nationwide.

The S&P 500 slid to round 5,030. The Nasdaq 100 dropped over 1%. Only a day after Jerome Powell thew chilly water on rate-cut bets, dip patrons emerged within the Treasury market, with two-year yields dropping additional beneath 5% and $13 billion sale of 20-year bonds drawing stable demand.

The US economic system has “expanded barely” since late February and companies reported better issue in passing on larger prices, the Federal Reserve mentioned in its Beige E book survey of regional enterprise contacts.

Powell signaled this week that policymakers will wait longer than beforehand anticipated to chop charges following a sequence of surprisingly excessive inflation readings. Fed officers narrowly penciled in three cuts in forecasts revealed final month — however traders at the moment are betting on only one to 2 this yr, futures markets present.

“Fed Chair Powell was downright hawkish,” mentioned Win Skinny and Elias Haddad at Brown Brothers Harriman. “The Fed desires the market to do the tightening for them. Monetary circumstances stay too unfastened and so some mixture of upper yields, wider spreads, stronger greenback, and decrease equities is required to tighten circumstances.”

Whereas world equities are dealing with tactical headwinds, that is only a consolidation part and shares are anticipated to maintain rising this yr, based on UBS strategists led by Andrew Garthwaite.