Synthetic intelligence has been round because the Fifties, however during the last a number of years the enterprise potential of AI has expanded dramatically. We now stay in a world the place massive information and highly effective computational capabilities enable AI to flourish. Corporations—together with insurance coverage carriers—are investing in establishing information lakes, optimizing for cloud-based operations and activating AI for focused analytics.

Insurers are seeing tangible outcomes from their present AI initiatives. Our AI maturity research shows that carriers’ share of value financial savings generated by AI greater than doubled between 2018 and 2021. We predict that share will triple by 2024. Moreover, insurers have been pretty glad with the return on their AI investments. Fifty two % of insurance coverage firms stated the return on their AI initiatives exceeded their expectations, whereas solely 3% stated the return didn’t meet expectations.

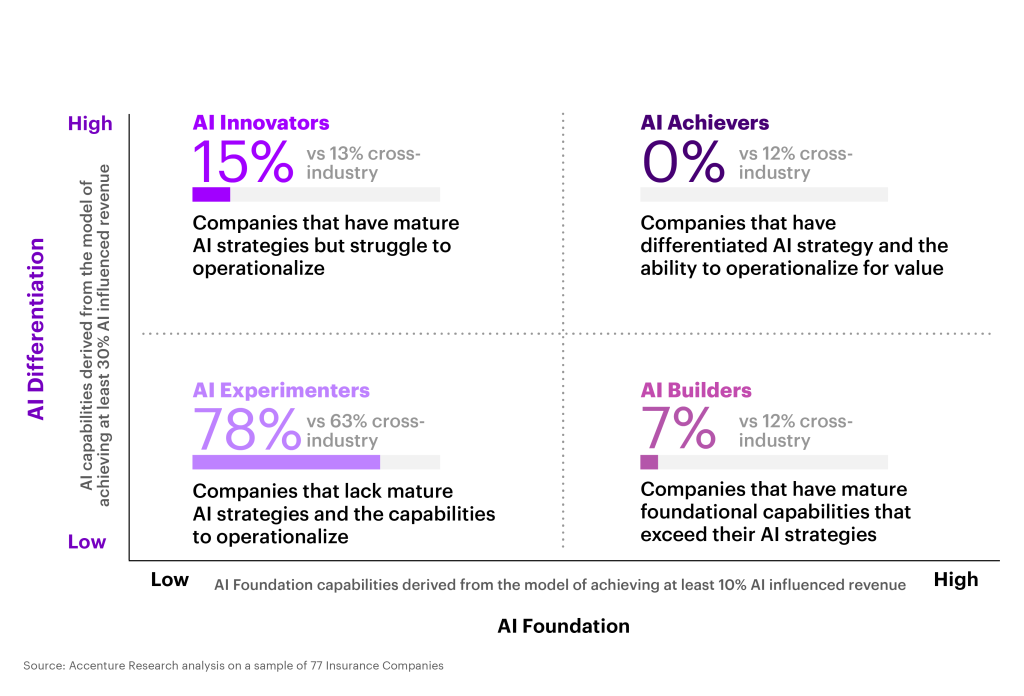

Nevertheless, insurers are leaving worth on the desk. In our evaluation of 77 insurance coverage firms, we discovered that none of them have been AI Achievers, which we outline as firms which have a differentiated AI technique and have operationalized AI to execute on that technique. In truth, most insurance coverage firms are within the AI Experimenter class, representing those that have the least-mature AI methods and lack the aptitude to operationalize AI.

Insurers can transfer into the Achiever class to appreciate higher worth by leveraging AI to energy complete enterprise reinvention. This consists of using AI in organization-wide decision-making and integrating AI into each a part of the enterprise—from enterprise course of optimization to delivering reimagined merchandise, companies and experiences to prospects.

Carriers trying to achieve momentum with their AI investments can discover alternatives within the entrance workplace and construct out their subsequent section of development. Our examine explored three key entrance workplace use instances that I’ll be diving into on this put up: buyer expertise, product and repair growth, and gross sales and advertising.

Buyer expertise intelligence and journey automation

In the case of buyer expertise optimization, insurers are starting to make progress in comparison with different industries—but they’re nonetheless within the early levels of AI activation.

Many insurers have invested in creating a single view of the shopper and have been in a position to perceive what merchandise prospects personal, if they’ve not too long ago made a declare or whether or not they have obtained a quote for one more product.

Whereas some insurers are beginning to achieve a greater understanding of the interactions they’ve with a given buyer, most insurers battle to attach the shopper journey throughout a number of channels and touchpoints. Far fewer are ready to make use of these insights to know the breakpoints in that have and tackle them systematically.

Although many insurers have invested in buyer relationship administration (CRM) platforms to share buyer insights throughout the enterprise, few have layered in AI to make use of these insights to orchestrate extremely customized buyer experiences that span advertising, gross sales, service and claims. Main CRM distributors are integrating AI capabilities into their platforms, making it simpler to embed out-of-the-box AI fashions into any workflow. Selecting such a expertise is a serious alternative to create omnichannel experiences and construct a very holistic view of every buyer.

In the case of automating elements of the shopper journey, conversational AI stays a largely untapped alternative for the insurance coverage trade as an entire. These which are creating self-contained conversational experiences that fulfill prospects’ wants—reasonably than merely answering FAQs or pointing prospects to the place they will get assist—are producing increased ranges of satisfaction with vital customer support value financial savings and lowered reliance on a difficult labor market.

New product and repair growth

Not too long ago, Accenture discovered that 88% of executives suppose their prospects’ wants are altering quicker than their companies can sustain with. Components like local weather change and financial uncertainty are forcing prospects to adapt to circumstances which are out of their management, shifting by territory as they attempt to make the selections which are greatest for them. Our analysis revealed a necessity for firms to shift from specializing in buyer as client to creating a nuanced understanding of the shopper as a multifaceted human being with complicated and infrequently contradictory needs.

This shift from customer-centricity to an method we’ve coined “life-centricity” is very related for carriers as they develop merchandise. AI may also help carriers widen their understanding of buyer conduct and transfer outdoors of cookie-cutter buyer profiles with information insights. It will probably assist them construct choices that may be tailor-made to the wants and habits of consumers as they transfer by their life, seamlessly recommending or upgrading people’ merchandise to reply to occasions like the acquisition of a brand new residence or offering protection as local weather change reshapes pure catastrophe danger.

There are many alternatives for insurers to create new services and products that use AI to appreciate extra worth and ship enhanced experiences. We’re already seeing many carriers implementing AI of their auto insurance coverage merchandise to evaluate driver conduct and provide pay-as-you-drive insurance policies.

As IoT and wearable expertise improves, carriers will have the ability to use AI to realize a good deeper understanding of buyer behaviors, assembly their wants and predicting what their wants is likely to be sooner or later. With a deeper understanding of the shopper, carriers can construct merchandise with a higher degree of personalization, at scale.

My colleague Jim Bramblet has explored a number of methods AI can provide another layer of protection for purchasers whereas gathering information about their danger profile and desires. One of many examples he discusses is an IoT-connected manufacturing facility ground, the place AI stops and begins machines as employees go, notifies group members about elements that want upkeep and permits them to view potential hazards through AR glasses.

Gross sales and advertising intelligence, suggestions and course of automation

Lastly, carriers can leverage AI to reinforce their gross sales and advertising efficiency. All through the advertising and gross sales funnel, carriers can implement AI to floor probably the most related suggestions to prospects and tackle their questions within the second. For instance, UK enterprise insurance coverage firm Tapoly makes use of AI at each buyer touchpoint to supply tailor-made business line insurance coverage merchandise to their goal market of micro-SMEs and freelancers. In addition they make use of AI to optimize pricing and danger evaluation based mostly on buyer information.

When prospects wish to communicate on to a stay particular person, AI can streamline the human-to-human experience and improve the probability that the shopper achieves the result they’re searching for. Brokers will profit from extra information and insights at their fingertips, which implies that they will seize upsell and cross-sell alternatives within the second. Brokers can depend on an AI assistant to floor probably the most related data in actual time and make suggestions as they communicate to a prospect.

Sompo has additionally partnered with AI CRM agency Vymo to construct AI-enabled proactive gross sales teaching expertise to enhance the service that their group gives. Ping An has developed a similar solution that serves up related buyer information in addition to real-time teaching help that enhances agent efficiency.

How insurers can grow to be AI Achievers

In our latest report, The Art of AI Maturity, we recognized 5 key areas firms must spend money on in the event that they wish to understand the total potential of AI and seize the worth that’s at stake.

- Be sure that management champions AI as a strategic precedence for the complete group. In the case of transformation, everyone seems to be a stakeholder. Leaders should be sure that their groups perceive the worth AI brings to their on a regular basis duties, and to the overarching enterprise objectives.

- Make investments closely in expertise to get extra from AI investments. Innovation comes from using a various group of individuals to unravel issues in distinctive and significant methods.

- Industrialize AI instruments and groups to create an “AI core.” To scale AI, carriers must create repeatable processes that create a powerful basis for elevated innovation as time goes on.

- Use AI responsibly, from the beginning. AI ethics and governance must be on the middle of each AI initiative as carriers scale. Right this moment, solely 35% of customers belief how AI is being applied by organizations. To retain prospects, carriers should display transparency and reduce bias.

- Plan long- and short-term investments. There is no such thing as a end line in relation to AI technique and innovation. Buyer wants will proceed to evolve, as will AI capabilities. Those that plan forward will keep forward as the necessity to adapt will increase.

AI’s potential in insurance coverage is much from being absolutely realized, however carriers that take the initiative to construct a powerful AI program at the moment will see a powerful return from these investments. I might love to debate how one can higher leverage AI in your entrance workplace, so please don’t hesitate to get in touch with me.

Reworking claims and underwriting with AI: AI has emerged because the crucial differentiator within the insurance coverage trade when utilized in tandem with people.

Get the most recent insurance coverage trade insights, information, and analysis delivered straight to your inbox.