Jump to winners | Jump to methodology

Seizing their probability

The most effective younger insurance coverage professionals are on the precipice of alternative as they navigate an business going through a sequence of challenges equivalent to a scarcity of expert employees, an getting older workforce, fast technological development, regulatory modifications, and shifting buyer preferences.

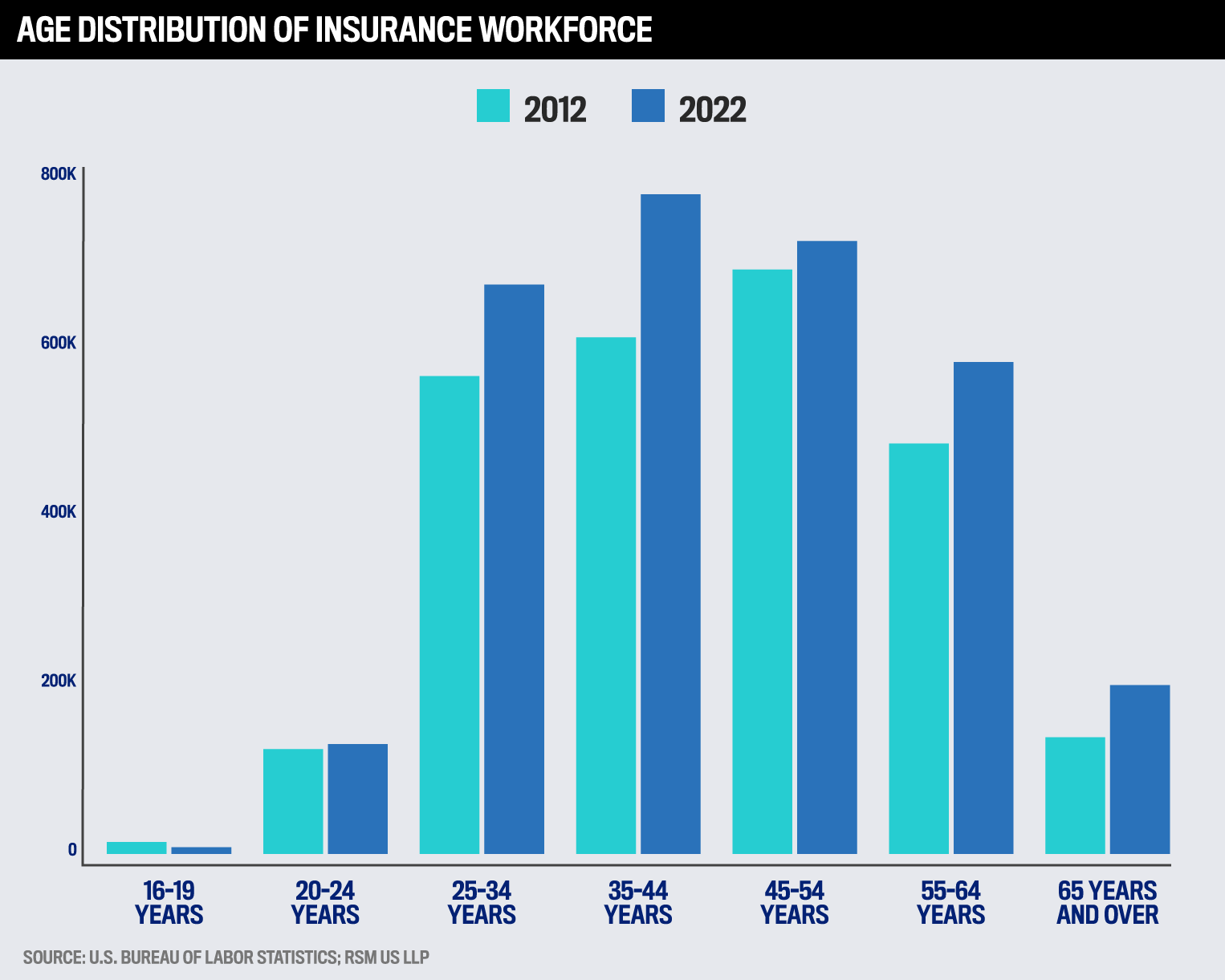

Knowledge from the US Bureau of Labor Statistics exhibits that round 400,000 folks will depart the workforce via attrition by 2026 and that it will likely be difficult to fill these gaps, as lower than 25 % of the business are underneath 35. As well as, the business is predicted to lose 50 % of its workforce to retirement by 2028.

This may open doorways for the leaders of tomorrow to step up and cement their place within the business, with Insurance coverage Enterprise America’s Rising Stars of 2024 on the forefront of this development.

Gail Audibert, business professional and president of Audibert Associates, underlines the potential rewards.

“The insurance coverage business has an getting older inhabitants, nevertheless it’s very dynamic. The variety of folks going to go away is very large, and there’s not that many individuals who’ve entered the business. So, anyone who’s new or early in a profession, there’s going to be such a groundswell of place folks shifting up, there’s going to be an unimaginable alternative.”

And he or she provides, “Insurance coverage touches each metropolis, state, city, neighborhood on the earth, and you must have insurance coverage. Most often, costs go up and down in smooth and onerous markets nevertheless it’s a really steady business and dates again to the Code of Hammurabi, 1750 BC.”

However solely these professionals who can transcend insurance coverage and respect the human connection will succeed. That’s the decision of IBA’s impartial judging panel of business consultants for 2024’s Rising Stars:

-

Kim Gore of HUB Worldwide

-

Victoria Discovered-Fenty of Massive I (Unbiased Insurance coverage Brokers & Brokers of America)

-

Pamela Wheeler of NFP

-

Denise Campbell of Marsh

-

Aaisha Hamid of Alliant Insurance coverage Providers

-

Randi Kasongo of Vacationers and the Nationwide African American Insurance coverage Affiliation – Los Angeles

“The winners actually elevated in that that they had a curiosity to study. Lots of them talked about how they proceed their profession improvement, their curiosity in issues, not solely simply insurance coverage, however issues which are ancillary and actually make a distinction to the business,” explains Gore. “It was nice to see that they needed to proceed to study. They have been actually invested within the business and all issues that touched it, and so they understood that persons are a very powerful factor we take care of, and people relationships must be constructed.”

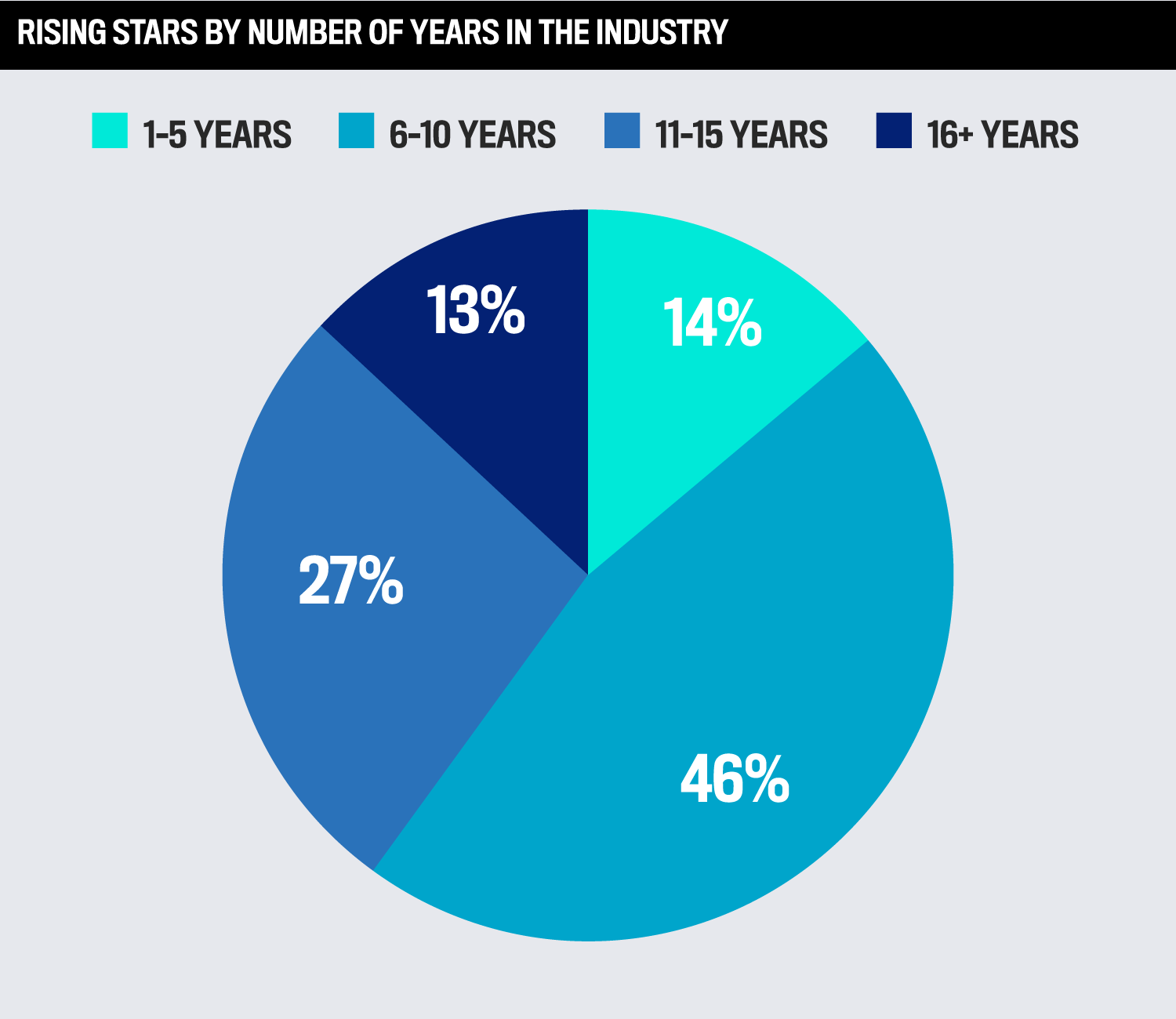

Nominees needed to be 40 or underneath (as of October 1, 2024) and dedicated to a profession in insurance coverage with a transparent ardour. Their present function, key achievements, profession objectives, and contributions in direction of shaping the business have been analyzed, with suggestions from managers and senior business professionals thought-about.

For Campbell, the important thing for the Rising Stars is to capitalize on probabilities to show themselves, no matter whether or not they’re in reinsurance, claims administration, or performing as brokers or suppliers.

“Every one in all these roles could have distinctive views and challenges that will or is probably not larger than yesterday. Challenges are nothing however alternatives when met with the proper angle,” she says.

Going to the highest

Kasongo, one other member of the judging panel, feels the time is ideal for IBA’s Rising Stars to develop into main gamers.

“Extra leaders are recognizing that younger professionals convey recent concepts and new views to established industries, making room for significant contributions on the desk. This could encourage younger professionals to proceed striving to be their greatest selves.”

This drive is why Brown & Using’s Grayson Lamb retains aspiring greater.

“I nonetheless don’t really feel like I’m the place I should be long-term, however changing into a shareholder within the firm on the finish of 2023 was a significant milestone for me,” he says. “I attempt to pitch and promote towards the gray-haired dealer, particularly with the market flip in 2022 and 2023 once they may promote a deal to an MGA with one coverage for $50–$70 million capability, whereas I’ve lower my tooth on shared layering accounts with as much as 5 to seven carriers.”

Specializing in actual property has enabled Lamb to excel.

“I do know that when a possible deal is available in, I’ve best-in-class market data and experience to get it over the road.”

Equally showcasing a strong need to succeed in the highest is Katelijne van Drongelen of Arch Insurance coverage Group. Over the previous 12 months, she helped launch an automatic submission consumption platform, with 75 % of enterprise projected to run it by the top of 2024.

“The standardization and digitization of knowledge is extremely essential within the business area, as a result of we’re getting requests for quotes and requests in 500 completely different codecs with various layers,” she feedback.

“We’ve constructed a platform that automates the method from a knowledge extraction perspective and gives a cue to the operations group to handle something that falls out of the automated submission consumption course of. It’s had a huge effect on our enterprise.”

Whereas for Brooke Leadbetter at Amwins, the problem was carving out a spot as a younger girl in a male-dominated business.

“I used to be in my early 20s going into rooms the place I’d be the one girl with 20–30 males, to pitch concepts. At first, I used to be intimidated, however then I used it as my superpower and leaned into it.”

From there, the sky has been the restrict as she has tripled her ebook of enterprise because of her drive and willpower.

“It was a number of getting out and assembly new retailers, and never essentially chilly calling, however heat calling. Nevertheless, cross-selling is a giant motive. Somebody might have a relationship in Salt Lake Metropolis or Seattle and I had to determine how we will get into these outlets and develop the Amwins model.”

A sensible transfer is to align with these already established and study from them, which is one thing Natalie Yuen of the Arch Insurance coverage Group did to construct her status.

“It’s about realizing the alternatives which are accessible to you and proving your self that you may progress. Whether or not it’s the enterprise or operational facet, you want sturdy supporters, and a giant hurdle might be discovering these folks.”

Within the first 5 years of her profession, Yuen realized the commerce earlier than alternatives started to current themselves.

“You begin getting introduced into conferences and folks search you out for recommendation. Then, it clicks that you’re doing issues proper. I needed to be a property dealer, after which I went into casualty, and switched from extra client-facing to market-facing,” she reveals.

Yuen believes there might be biases towards younger professionals, notably early of their profession.

“We’re nonetheless at a stage the place grey hair is valued. Nevertheless, the second you’ll be able to articulate your worth proposition to somebody, it doesn’t matter what age, gender, or ethnicity you’re. I need to proceed to evolve and be a part of the way forward for insurance coverage.”

How the Greatest Insurance coverage Professionals Below 40 made their mark

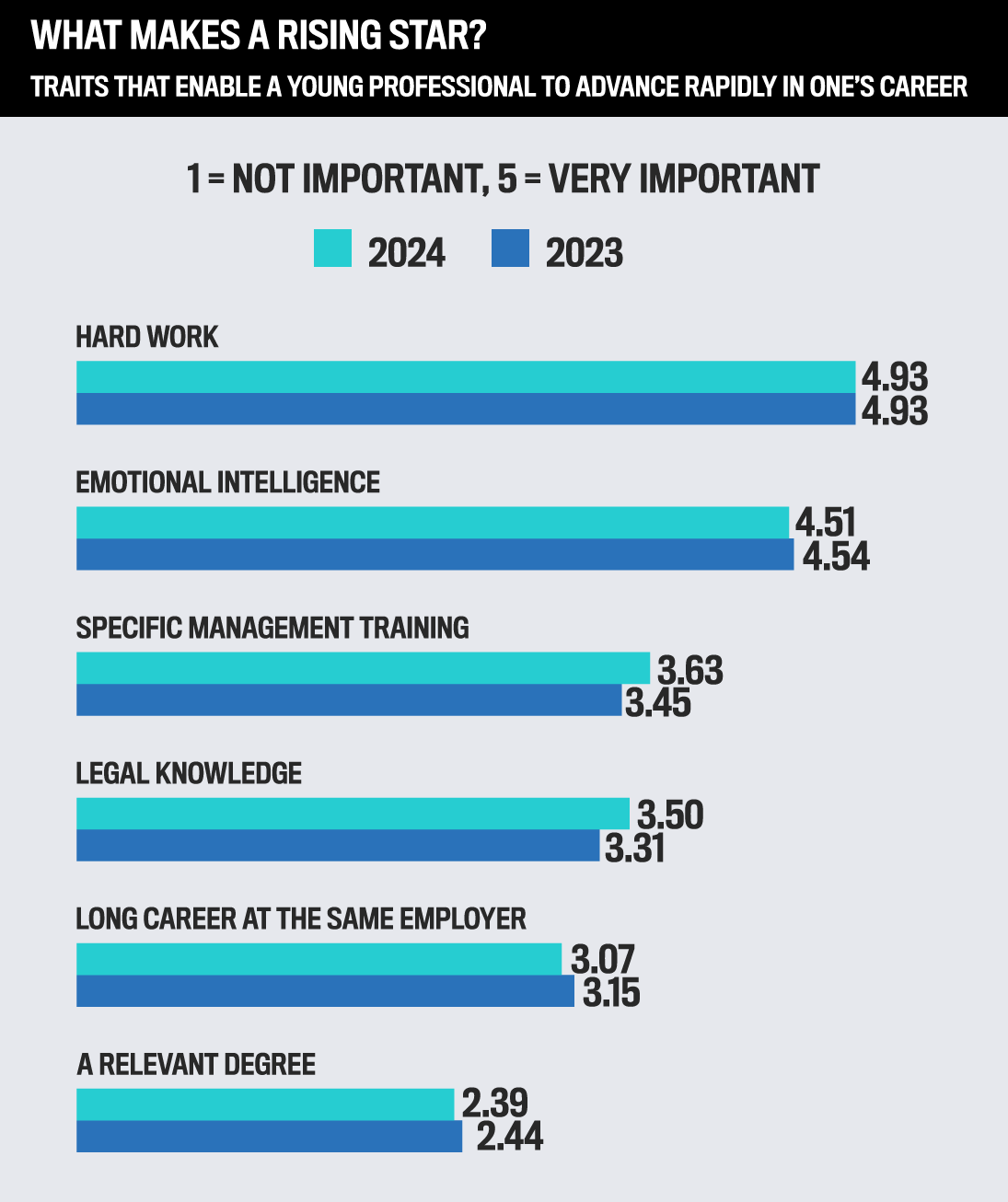

Nominees have been requested to stipulate a very powerful sides that generate profession fast development. In comparison with 2023, the identical prime three expertise have been onerous work, emotional intelligence, and particular administration coaching with a related diploma being final.

This underlines that the Rising Stars are succeeding because of their means to suppose laterally and join with their shoppers.

Matt Domitrovich – Amwins

Location: Chicago, IL

Age: 39

Efficiently main a manufacturing group that surpassed $5 million in income in 2024 has marked him out.

“The general public have labored with me for the final 5-10 years and to go from 0 to over $5 million with one hundred pc natural development is a major achievement. Taking the straightforward means out is rarely a key to success. We now have one of the best group within the business,” says Domitrovich.

“I don’t know if there’s ever been a greater time to be an adolescent within the business. In the event you’re an underwriter, employers solely care about your means to put in writing worthwhile enterprise. In the event you can show that, you’re going to be a rockstar.”

David Lê – Aspen Insurance coverage Group

Location: New York, NY

Age: 26

Assistant vice chairman of US distribution and advertising and marketing, co-chair of the Gender and Inclusion Community and member of the DE&I committee, Lê can be an government nationwide board member on the Asian American Insurance coverage Community (AAIN).

“I like speaking, so I needed to steadiness that with my creativity, and that’s how I went into advertising and marketing,” he says.

Rising up within the Bronx in an immigrant household, Lê prides himself on a hardworking mentality. He helps strategic engagement backed by knowledge with key insurance coverage buying and selling companions, whereas additionally driving initiatives geared toward elevating Aspen’s model presence through promoting and graphic design, curated occasions, and e-marketing.

Grayson Lamb – Brown & Using

Location: Dallas, TX

Age: 31

Working his means from manufacturing assistant to principal and senior vice chairman, Lamb values collaboration.

He says, “I lately went to Cincinnati and Columbus to satisfy potential new shoppers and a few that we’ve got on our books already. After I got here again, I ensured our group was on top of things with our shoppers’ wants.”

A hardworking mindset is on the forefront of Lamb’s ethos.

“What we’re doing within the wholesale area is entrepreneurial. You’ve bought to exit and seize it. There is no such thing as a one pushing you, nevertheless it’s about having that drive to develop your ebook of enterprise.”

Katelijne van Drongelen – Arch Insurance coverage Group

Location: Raleigh, NC

Age: 39

As vice chairman of software program engineering within the property area, she leads two groups of 80 engineers to develop property consumption clearance, underwriting and declare options.

She initially discovered it robust in a historically male dominated sector.

“A few of it was overcoming my very own insecurities about being in a spot the place I didn’t actually see lots of people that appear like me, particularly in management positions. I developed confidence over time, getting into in a room when you’re capable of ship tasks efficiently builds appreciable confidence,” she says.

Van Drongelen’s means to construct relationships and innovate are key.

“What I convey to the desk is transformation and that will get folks’s consideration. No insurance coverage firm desires to listen to about how they’re going to catch as much as the competitors. They need what’s going to make them completely different, as a result of when you’re making an attempt to catch up, you’re going within the improper course.”

Taylor Forst – Alliant Insurance coverage Providers

Location: San Francisco, CA

Age: 31

Specializing in legal responsibility insurance coverage for the true property business, her main accountability is serving shoppers who personal or handle house buildings and different habitational properties.

“I like constructing that rapport, and assembly folks head to head. I attempt to be there once they want me and take note of element,” he says.

Forst’s function includes aiding in procuring insurance coverage protection tailor-made to the particular wants and dangers, through thorough assessments of their properties and analyzing potential liabilities.

“I like moving into the nitty-gritty of types and protection.”

Lorenzo Marini – ARI Monetary Group

Location: Miami, FL

Age: 28

A professional electrical engineer turned insurance coverage skilled, he designs tailor-made life insurance coverage insurance policies and builds sturdy relationships with high-net-worth people. Marini began when ARI used a third-party IT firm and was supervising as a knowledge analyst.

“I begin suggesting modifications to processes and the monetary facet of issues. A yr after becoming a member of, I used to be supplied a job with an engineering agency, however I made a decision to stick with ARI as a result of I used to be having fun with my work right here,” reveals Marini.

From there, he’s develop into an professional at tailoring and designing insurance policies, and is now a director.

“I care about my shoppers, I’m not transactional, and I convey a degree of sophistication,” he says.

Brooke Leadbetter – Amwins

Location: Scottsdale, AZ

Age: 30

An professional within the builder’s threat subcategory of property and insurance coverage, the senior vice chairman manages a manufacturing group and has seen her ebook of enterprise develop from $25 million to $73 million in premium over the previous 4 years.

“I bought the chance to take over a small ebook of enterprise in Portland, and I moved there for a quick time frame, and it’s continued to develop. After I began, there have been two folks on the group and now we’ve got seven.”

She continues, “It’s about being younger and hungry, as a result of when you lose that enthusiasm, you may get complacent. Folks acknowledge that and need to work with people who find themselves keen to assist them win.”

Shadi Jalali – Alliant Insurance coverage Providers

Location: San Francisco, CA

Age: 34

A licensed property and casualty insurance coverage producer working with entities such because the Port of Seattle, California State College, College of California, and the Metropolis of San Jose.

“My largest achievement has been changing into a commissioned producer with my very own ebook of enterprise,” she says.

Adopting a strategic mindset has been essential.

“It’s a people-based job. It’s extremely essential to accomplice with the proper carriers and shoppers. With over a decade within the business, I’ve these relationships in place, and it makes my job a lot simpler and much more enjoyable.”

Patrick Goodwin – Arch Insurance coverage Group

Location: New York, NY

Age: 36

A vice chairman and section chief, he has regional administration duties within the northeast and southeast areas for the surplus and surplus (E&S) casualty underwriting group. Within the first six months of 2024, the E&S casualty group loved a 20 % improve in written premium, with half coming from areas that Goodwin straight manages.

He says, “I’ve a superb understanding of the place the corporate desires to take E&S casualty and the place the market is shifting. I’m tuned into our rivals – the enterprise that they’re writing and watching their efficiency. That each one performs into how I resolve on technique by noticing traits.”

Tyler Jensen – InsuraRisk College

Location: Ogden, UT

Age: 29

As founder and president of InsuraRisk College, he gives brokers with the instruments they want, equivalent to motivational insights and private improvement.

“I noticed too many brokers depart the business inside their first 5 years. I studied prime producers throughout the US to know what it takes to be a prime performer,” he says. “I put collectively my very own frameworks and a roadmap that brokers can observe to run a profitable enterprise throughout the insurance coverage area, the place shoppers need to keep due to the tradition they’ve constructed.”

Jamie Behymer – Unbiased Insurance coverage Brokers & Brokers of America

Location: Alexandria, VA

Age: 27

Solely becoming a member of the business in 2022, she has skilled a meteoric rise. As program supervisor, Behymer oversees a number of sides and together with agent improvement, crafting, and implementing methods to reinforce agent efficiency and development.

“I’ve the reward of the gab, however I additionally like to hear and study extra about others. That’s crucial in my function as I’m not customer-facing. If one thing goes improper, I’m capable of suppose on my toes and give you a plan B instantly,” she says.

Natalie Yuen – Arch Insurance coverage Group

Location: San Francisco, CA

Age: 40

Main enterprise improvement for the corporate’s west area, she is accountable for driving every enterprise unit’s development technique throughout 13 states.

“Plenty of my function is merging that knowledge with the folks side of the enterprise, as a result of that’s nonetheless what closely drives insurance coverage,” Yuen says.

She listens and engages with colleagues.

“It’s about staying curious, it doesn’t matter what level of your profession you’re at. In the event you lose that, you develop into complacent.”

Katelynn Fellows – Danger Placement Providers

Location: Woodstock, GA

Age: 29

As space assistant vice chairman, Fellows controls the location of varied business properties, together with layered and shared packages, builder’s threat ground-up development, and renovation tasks.

She says, “Selecting up the telephone has helped me achieve success. I discover lots of people in our business don’t make calls and would moderately ship emails. It’s simpler to construct a relationship over the telephone moderately than hiding behind an electronic mail.”

In 2015, the yr she joined, the group’s premium was $61 million. It has grown to $300 million by 2023.

“We take care of massive excess-and-surplus strains, property accounts, for builders, threat development, renovations, single payroll, earthquake and flood offers, all throughout the US. I purpose to streamline our processes to assist us develop into extra environment friendly as a group,” Fellows says.

- Albert Huang, RPLU

AVP, Underwriter

At-Bay - Alex Kahn

Assistant Vice President, Surety Claims

Skyward Specialty Insurance coverage Group - Allyson Lundsford

AVP, Head of Associate Administration

Nautilus Insurance coverage Group - Amber Johnson

Affiliate Consumer Advisory, AVP

Marsh USA - Amy LaFond

Account Govt

The Buckner Firm - Andrew McNeil

Senior Advantages Advisor

Arrow Advantages Group - Ashley Arikawa

Director of Advertising and marketing & Communications

Ori-gen - Ashley Engl

Enterprise Growth Supervisor

Jencap Specialty Insurance coverage Providers - Barb Habel

Vice President & Head of Extra Legal responsibility

Atain Insurance coverage Firms - Brian Harmer

Vice President, Underwriting

Tangram Insurance coverage Providers - Brian Stone

Business Insurance coverage Advisor

Leavitt United Insurance coverage Providers (Leavitt Group) - Brittany Sotomayor

Center Market Broking Chief

Willis Towers Watson - Feada Kakish

Affiliate Dealer

Aon - Camdon Turley

Licensed Gross sales Producer

Allstate: Katie Woods Insurance coverage Company - Catherine White

Director, Member Advocates

PURE Insurance coverage - Cecil Varghese

Property Dealer

Aon - Connor Bowen

Assistant Vice President

Mosaic Insurance coverage - Courtney Maugé

Cyber Observe Chief

NFP, An Aon Firm - Crystal Cathcart

Product Gross sales Govt

Verisk - Dalton DeFendis

Vice President

DiBuduo & DeFendis Insurance coverage Brokers - Dylan Campbell

Casualty Dealer

CRC Group - Elliot Bassett

President

Ellerbrock-Norris - Emma Woerner

Assistant Vice President, Cyber/E&O Dealer

Willis Towers Watson - Emmanuel Delgado

Company Proprietor and Business Insurance coverage Agent

Delgado Insurance coverage - Erica Weill

Gross sales Govt

Imperial PFS - Erich Schutz

Vice President, Nationwide Observe Chief Hashish

Jencap Group - Erik Davis

Assistant Vice President

Kevin Davis Insurance coverage Providers - Erin Mitton

Manufacturing UW Supervisor

Nice American Insurance coverage, Environmental - Erin Rose Hainey

Underwriting Supervisor

Intact Insurance coverage Group - Georgia Schelberger

Enterprise Growth Supervisor

Berkley Mid-Atlantic Insurance coverage Group - Gregory Lyons

Associate

Elite Specialty & Wholesale Insurance coverage Providers - Hadassah Masudi Minga

Director of Enterprise Efficiency Analytics

Vacationers Insurance coverage - Jatin Sharma

Founder, Managing Associate

Nardac, an Amwins Firm - Jenna Silva

Techniques Integration and Course of Chief

C3 Danger & Insurance coverage - Jennifer Kessel

Vice President of Operations

USG Insurance coverage Providers - Jesse Jorgensen

Consumer Govt

Marsh McLennan Company - Jessica Waite

Consumer Advisor

C3 Danger & Insurance coverage - Jonathan Wheat

Senior Vice President and Principal

EPIC Insurance coverage Brokers & Consultants - Jordan Muckway

Business Strains Supervisor

Burns & Wilcox - Julianna Parvani

Account Govt

Fred C. Church, Assured Companions - Justin Jacobs

Govt Vice President, Advertising and marketing

IMA Monetary Group - Kai Zwiebel

Advertising and marketing Supervisor

Cothrom Danger & Insurance coverage Providers - Karthikeyan Vaidyalingam

World Head, Cloud and AI Safety

MetLife Group - Kelley Carter

Vice President of Private Strains

Alternative Insurance coverage Company - Kelly Cervantes

Assistant Vice President, Western Area

Resilience - Kelly J. Successful

SVP, Underwriting Middle Lead

Chubb - Kevin Fukuyama

President

Ori-gen - Khanh Le

Senior Underwriter

Skilled Program Insurance coverage Brokerage - Kristin Brown

Assistant Vice President of WC/P&C TPA

Davies - Kristin Hanson

AVP Account Govt

Aon - Kristina Marcigliano

Vice President

Danger Methods - Lauren Loef

Lead Affiliate Dealer, FINEX Cyber/E&O

Willis Towers Watson - Leanna Peppercorn

Senior Casualty Advisor

Marsh USA - Lilianne Padron

Senior Account Supervisor

Brown & Brown - Lindsay Cunney

Vice President, World Consumer Govt

Chubb - Lindsay Nietfeld

Account Supervisor

Assured Companions of Oregon LLC - Logan Cheadle

Nationwide Observe Chief, Enrollment Technique & Voluntary Advantages

IMA Monetary Group - Lyndsey Jarvis

Director of Business Claims

Davies - Mariah Shields

Senior Advantages Guide/Half Proprietor

Arrow Advantages Group - Maribel Barranco

Manufacturing Specialist, Business Underwriter, P&C Center Market

Chubb - Marife Molina

EVP, Strategic Income

C3 Danger & Insurance coverage - Marina Seddik-Rastetter

Service Consultant

Amalgamated Life Insurance coverage Firm - Matthew C. Daley

Agent and Proprietor

The Daley Company/American Nationwide Insurance coverage Firm - Maxwell Lin

Claims Advocate

C3 Danger & Insurance coverage - Megan Easley

Senior Vice President, Contingent Danger

CAC Specialty - Michael Pistone

Program Supervisor

Ryan Specialty Transportation Underwriting Managers (RSTUM) - Michele Fredrikson

Senior Vice President, Casualty Dealer

Brown & Brown - Mike Kinoshita

Govt Vice President

Aihara & Associates Insurance coverage Providers - Nadine Kuznetsova

Senior Account Supervisor

Worthy Insurance coverage - Nina Rodriquez

Senior Property Underwriter, Western Area

Berkshire Hathaway Specialty Insurance coverage - Paul Glover

Vice President

Woodruff Sawyer - Scott Tardif

Senior Manufacturing Underwriter

Nice American Insurance coverage Group, Environmental Division - Shaina Miller

Managing Director

Higginbotham - Shana Stodolski

Vice President, Cyber and Know-how

Ambridge - Shantelle Cabir

Senior Vice President, Enterprise Insurance coverage Guide

Newfront - Stephanie Ritz

Analytics Supervisor

Key Danger - Stephen Wallace

Vice President, Underwriting, Business Casualty

QBE North America - Tolga Tezel

Founder and CEO

Cover Join - Traci Hastings

Underwriting Supervisor

Markel Specialty - Walker McKenzie

Casualty Dealer and AVP

CRC Group - Will Tschetter

Senior Vice President

INSUREtrust - William Curto

Underwriting Operations Supervisor

Tokio Marine HCC