Carding — the underground enterprise of stealing, promoting and swiping stolen fee card information — has lengthy been the dominion of Russia-based hackers. Fortunately, the broad deployment of safer chip-based fee playing cards in the USA has weakened the carding market. However a flurry of innovation from cybercrime teams in China is respiration new life into the carding trade, by turning phished card information into cellular wallets that can be utilized on-line and at most important avenue shops.

A picture from one Chinese language phishing group’s Telegram channel reveals numerous toll street phish kits accessible.

In case you personal a cell phone, the probabilities are glorious that in some unspecified time in the future up to now two years it has obtained no less than one phishing message that spoofs the U.S. Postal Service to supposedly gather some excellent supply charge, or an SMS that pretends to be an area toll street operator warning of a delinquent toll charge.

These messages are being despatched by means of refined phishing kits offered by a number of cybercriminals primarily based in mainland China. And they aren’t conventional SMS phishing or “smishing” messages, as they bypass the cellular networks fully. Reasonably, the missives are despatched by means of the Apple iMessage service and thru RCS, the functionally equal expertise on Google telephones.

Individuals who enter their fee card information at one in every of these websites will probably be advised their monetary establishment must confirm the small transaction by sending a one-time passcode to the client’s cellular gadget. In actuality, that code will probably be despatched by the sufferer’s monetary establishment to confirm that the person certainly needs to hyperlink their card info to a cellular pockets.

If the sufferer then supplies that one-time code, the phishers will hyperlink the cardboard information to a brand new cellular pockets from Apple or Google, loading the pockets onto a cell phone that the scammers management.

CARDING REINVENTED

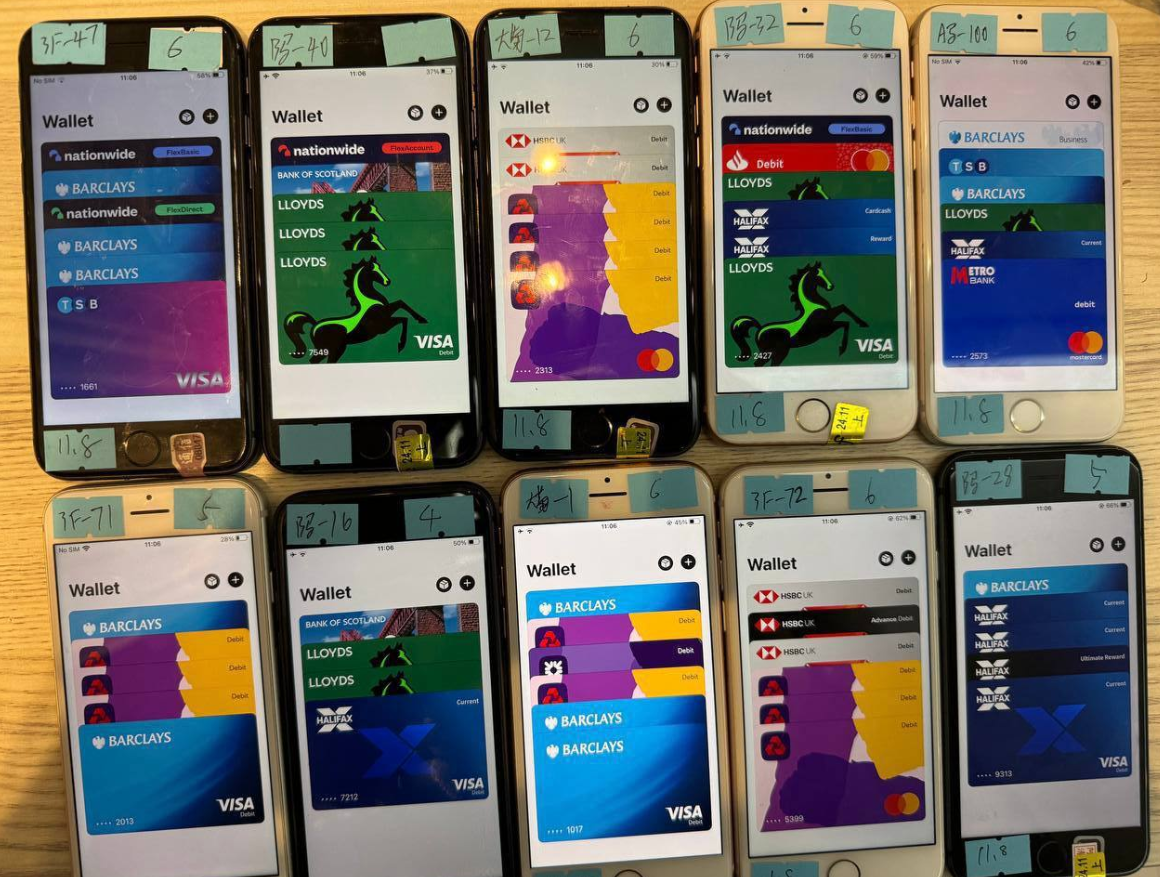

Ford Merrill works in safety analysis at SecAlliance, a CSIS Security Group firm. Merrill has been learning the evolution of a number of China-based smishing gangs, and located that the majority of them characteristic useful and informative video tutorials of their gross sales accounts on Telegram. These movies present the thieves are loading a number of stolen digital wallets on a single cellular gadget, after which promoting these telephones in bulk for lots of of {dollars} apiece.

“Who says carding is useless?,” stated Merrill, who introduced about his findings on the M3AAWG safety convention in Lisbon earlier right this moment. “That is the most effective magazine stripe cloning gadget ever. This menace actor is saying you might want to purchase no less than 10 telephones, and so they’ll air ship them to you.”

One promotional video reveals stacks of milk crates stuffed stuffed with telephones on the market. A more in-depth inspection reveals that every telephone is affixed with a handwritten notation that usually references the date its cellular wallets have been added, the variety of wallets on the gadget, and the initials of the vendor.

A picture from the Telegram channel for a well-liked Chinese language smishing package vendor reveals 10 cellphones on the market, every loaded with 4-6 digital wallets from completely different UK monetary establishments.

Merrill stated one frequent approach felony teams in China are cashing out with these stolen cellular wallets entails establishing pretend e-commerce companies on Stripe or Zelle and operating transactions by means of these entities — usually for quantities totaling between $100 and $500.

Merrill stated that when these phishing teams first started working in earnest two years in the past, they’d wait between 60 to 90 days earlier than promoting the telephones or utilizing them for fraud. However today that ready interval is extra like simply seven to 10 days, he stated.

“After they first put in this, the actors have been very affected person,” he stated. “These days, they solely wait like 10 days earlier than [the wallets] are hit exhausting and quick.”

GHOST TAP

Criminals can also money out cellular wallets by acquiring actual point-of-sale terminals and utilizing tap-to-pay on telephone after telephone. However in addition they provide a extra cutting-edge cellular fraud expertise: Merrill discovered that no less than one of many Chinese language phishing teams sells an Android app known as “ZNFC” that may relay a legitimate NFC transaction to anyplace on this planet. The person merely waves their telephone at an area fee terminal that accepts Apple or Google pay, and the app relays an NFC transaction over the Web from a telephone in China.

“The software program can work from anyplace on this planet,” Merrill stated. “These guys present the software program for $500 a month, and it could possibly relay each NFC enabled tap-to-pay in addition to any digital pockets. The even have 24-hour assist.”

The rise of so-called “ghost faucet” cellular software program was first documented in November 2024 by safety consultants at ThreatFabric. Andy Chandler, the corporate’s chief business officer, stated their researchers have since recognized quite a few felony teams from completely different areas of the world latching on to this scheme.

Chandler stated these embody organized crime gangs in Europe which might be utilizing related cellular pockets and NFC assaults to take cash out of ATMs made to work with smartphones.

“Nobody is speaking about it, however we’re now seeing ten completely different methodologies utilizing the identical modus operandi, and none of them are doing it the identical,” Chandler stated. “That is a lot larger than the banks are ready to say.”

A November 2024 story within the Singapore day by day The Straits Instances reported authorities there arrested three overseas males who have been recruited of their dwelling international locations through social messaging platforms, and given ghost faucet apps with which to buy costly gadgets from retailers, together with cellphones, jewellery, and gold bars.

“Since Nov 4, no less than 10 victims who had fallen for e-commerce scams have reported unauthorised transactions totaling greater than $100,000 on their bank cards for purchases comparable to digital merchandise, like iPhones and chargers, and jewellery in Singapore,” The Straits Instances wrote, noting that in one other case with an identical modus operandi, the police arrested a Malaysian man and girl on Nov 8.

Three people charged with utilizing ghost faucet software program at an electronics retailer in Singapore. Picture: The Straits Instances.

ADVANCED PHISHING TECHNIQUES

Based on Merrill, the phishing pages that spoof the USPS and numerous toll street operators are powered by a number of improvements designed to maximise the extraction of sufferer information.

For instance, a would-be smishing sufferer may enter their private and monetary info, however then determine the entire thing is rip-off earlier than really submitting the info. On this case, something typed into the info fields of the phishing web page will probably be captured in actual time, no matter whether or not the customer really clicks the “submit” button.

Merrill stated individuals who submit fee card information to those phishing websites usually are then advised their card can’t be processed, and urged to make use of a distinct card. This method, he stated, generally permits the phishers to steal multiple cellular pockets per sufferer.

Many phishing web sites expose sufferer information by storing the stolen info instantly on the phishing area. However Merrill stated these Chinese language phishing kits will ahead all sufferer information to a back-end database operated by the phishing package distributors. That approach, even when the smishing websites get taken down for fraud, the stolen information continues to be secure and safe.

One other necessary innovation is the usage of mass-created Apple and Google person accounts by means of which these phishers ship their spam messages. One of many Chinese language phishing teams posted photographs on their Telegram gross sales channels displaying how these robotic Apple and Google accounts are loaded onto Apple and Google telephones, and organized snugly subsequent to one another in an expansive, multi-tiered rack that sits instantly in entrance of the phishing service operator.

The ashtray says: You’ve been phishing all evening.

In different phrases, the smishing web sites are powered by actual human operators so long as new messages are being despatched. Merrill stated the criminals seem to ship only some dozen messages at a time, seemingly as a result of finishing the rip-off takes handbook work by the human operators in China. In any case, most one-time codes used for cellular pockets provisioning are typically solely good for a couple of minutes earlier than they expire.

Notably, not one of the phishing websites spoofing the toll operators or postal providers will load in a daily Internet browser; they are going to solely render in the event that they detect {that a} customer is coming from a cellular gadget.

“One of many causes they need you to be on a cellular gadget is they need you to be on the identical gadget that’s going to obtain the one-time code,” Merrill stated. “Additionally they wish to decrease the probabilities you’ll go away. And in the event that they wish to get that cellular tokenization and seize your one-time code, they want a stay operator.”

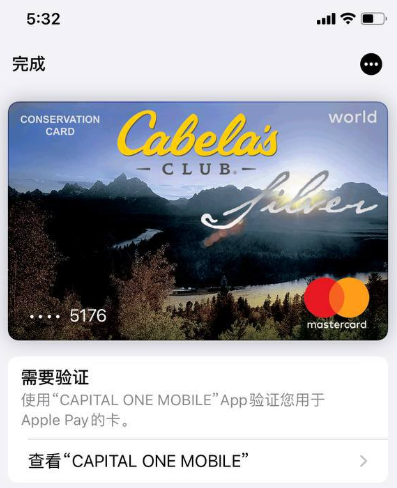

Merrill discovered the Chinese language phishing kits characteristic one other innovation that makes it easy for purchasers to show stolen card particulars right into a cellular pockets: They programmatically take the cardboard information equipped by the phishing sufferer and convert it right into a digital picture of an actual fee card that matches that sufferer’s monetary establishment. That approach, trying to enroll a stolen card into Apple Pay, for instance, turns into as simple as scanning the fabricated card picture with an iPhone.

An advert from a Chinese language SMS phishing group’s Telegram channel displaying how the service converts stolen card information into a picture of the stolen card.

“The telephone isn’t sensible sufficient to know whether or not it’s an actual card or simply a picture,” Merrill stated. “So it scans the cardboard into Apple Pay, which says okay we have to confirm that you just’re the proprietor of the cardboard by sending a one-time code.”

PROFITS

How worthwhile are these cellular phishing kits? The very best guess to this point comes from information gathered by different safety researchers who’ve been monitoring these superior Chinese language phishing distributors.

In August 2023, the safety agency Resecurity discovered a vulnerability in a single well-liked Chinese language phish package vendor’s platform that uncovered the non-public and monetary information of phishing victims. Resecurity dubbed the group the Smishing Triad, and located the gang had harvested 108,044 fee playing cards throughout 31 phishing domains (3,485 playing cards per area).

In August 2024, safety researcher Grant Smith gave a presentation on the DEFCON safety convention about monitoring down the Smishing Triad after scammers spoofing the U.S. Postal Service duped his wife. By figuring out a distinct vulnerability within the gang’s phishing package, Smith stated he was capable of see that individuals entered 438,669 distinctive bank cards in 1,133 phishing domains (387 playing cards per area).

Based mostly on his analysis, Merrill stated it’s affordable to count on between $100 and $500 in losses on every card that’s changed into a cellular pockets. Merrill stated they noticed almost 33,000 distinctive domains tied to those Chinese language smishing teams throughout the yr between the publication of Resecurity’s analysis and Smith’s DEFCON speak.

Utilizing a median variety of 1,935 playing cards per area and a conservative lack of $250 per card, that comes out to about $15 billion in fraudulent costs over a yr.

Merrill was reluctant to say whether or not he’d recognized further safety vulnerabilities in any of the phishing kits offered by the Chinese language teams, noting that the phishers rapidly mounted the vulnerabilities that have been detailed publicly by Resecurity and Smith.

FIGHTING BACK

Adoption of touchless funds took off in the USA after the Coronavirus pandemic emerged, and plenty of monetary establishments in the USA have been desperate to make it easy for purchasers to hyperlink fee playing cards to cellular wallets. Thus, the authentication requirement for doing so defaulted to sending the client a one-time code through SMS.

Specialists say the continued reliance on one-time codes for onboarding cellular wallets has fostered this new wave of carding. KrebsOnSecurity interviewed a safety govt from a big European monetary establishment who spoke on situation of anonymity as a result of they weren’t approved to talk to the press.

That knowledgeable stated the lag between the phishing of sufferer card information and its eventual use for fraud has left many monetary establishments struggling to correlate the causes of their losses.

“That’s a part of why the trade as a complete has been caught without warning,” the knowledgeable stated. “Lots of people are asking, how that is attainable now that we’ve tokenized a plaintext course of. We’ve by no means seen the amount of sending and folks responding that we’re seeing with these phishers.”

To enhance the safety of digital pockets provisioning, some banks in Europe and Asia require prospects to log in to the financial institution’s cellular app earlier than they’ll hyperlink a digital pockets to their gadget.

Addressing the ghost faucet menace might require updates to contactless fee terminals, to higher determine NFC transactions which might be being relayed from one other gadget. However consultants say it’s unrealistic to count on retailers will probably be keen to switch present fee terminals earlier than their anticipated lifespans expire.

And naturally Apple and Google have an elevated function to play as properly, on condition that their accounts are being created en masse and used to blast out these smishing messages. Each corporations might simply inform which of their gadgets all of a sudden have 7-10 completely different cellular wallets added from 7-10 completely different individuals world wide. They may additionally suggest that monetary establishments use safer authentication strategies for cellular pockets provisioning.

Neither Apple nor Google responded to requests for touch upon this story.