How a lot do insurance coverage brokers make? This relies on a variety of things

What entices many to take up a profession in insurance coverage gross sales is the robust incomes potential that comes with it. However how a lot do insurance coverage brokers make?

Insurance coverage Enterprise solutions this query and extra on this article. Whether or not you’re a curious client itching to know the way a lot your agent earns otherwise you’re an insurance coverage skilled wanting to check your earnings with these of others within the trade, this piece might help give you helpful data. Learn on and learn the way a lot insurance coverage brokers actually make, and the elements that affect their incomes potential on this information.

Insurance coverage brokers earn a imply annual wage of $79,650 or an hourly charge of $37, in accordance with the most recent knowledge from the Bureau of Labor Statistics (BLS). Whereas beginning wages might be considerably decrease than this quantity, trade veterans with a longtime consumer community can simply earn a six-figure wage.

In developing with the common, the bureau thought of all varieties of insurance coverage brokers, together with specialists that promote property and casualty, life and well being, and different kinds of insurance coverage insurance policies for an employment estimate of 455,540. The desk beneath reveals the percentile wage estimates for insurance coverage brokers based mostly on BLS’ most up-to-date Occupational Employment and Wage Statistics (OEWS).

How a lot insurance coverage brokers make from lowest to highest common

|

PERCENTILE WAGE ESTIMATES (INSURANCE AGENTS)

|

||

|---|---|---|

|

Percentile

|

Annual wage

|

Hourly wage

|

|

10%

|

$31,530

|

$15.16

|

|

25%

|

$40,030

|

$19.25

|

|

50% (Median)

|

$57,860

|

$27.82

|

|

75%

|

$81,970

|

$39.41

|

|

90%

|

$130,350

|

$62.67

|

Insurance coverage brokers normally earn cash by way of commissions, with the fee quantity typically relying on the kind and variety of insurance coverage insurance policies they’ve bought and whether or not these insurance policies are new or renewals.

For brand new residence and auto insurance policies, captive insurance coverage brokers obtain between 5% and 10% of the full premiums for the primary yr, whereas impartial brokers earn about 15%. For renewals, the speed is round 2% to fifteen%, though the common is between 2% and 5%. We’ll talk about the several types of insurance coverage brokers in additional element later.

Life insurance coverage brokers, in the meantime, obtain front-loaded commissions of 40% to as much as 115% of the coverage’s first-year premiums, though these for renewals nosedive to about 1% or 2%. Some brokers even cease receiving commissions after the third yr. If you wish to know the way a lot precisely life insurance coverage brokers make, you possibly can test this text that we ready.

Many insurance coverage brokers additionally work full-time as salaried staff for insurance coverage corporations and businesses. Relying on their contract, they could earn a set wage or this plus commissions. Corporations might also present workers bonuses in the event that they attain a sure revenue goal.

In abstract, listed below are the methods insurance coverage brokers earn cash:

- Commissions solely

- Wage solely

- Wage and commissions

- Wage and bonuses

Aside from the fee construction, there are three primary elements that affect how a lot insurance coverage brokers make. These are:

1. Kind of agent

Insurance coverage brokers are contracted by associate insurers to distribute their merchandise. They arrive in two sorts:

- Captive brokers: Who work solely with an insurance coverage supplier.

- Impartial brokers: Who characterize a number of insurance coverage corporations.

Typically, impartial brokers earn greater commissions than their captive counterparts, however there’s a catch – impartial brokers typically shoulder their very own enterprise bills, together with lease, workplace provides, and promoting and advertising prices.

2. Kind of coverage

Insurance coverage brokers usually select a line or two to concentrate on. This could embody auto, residence, life, well being, and enterprise insurance coverage. As talked about earlier, fee charges are greater for brand spanking new life and well being insurance policies, though the quantity drops after renewal. For automobile and residential insurance coverage insurance policies, the charges don’t differ that a lot after the primary yr.

3. Location

Employment charges, price of residing, public safety and accident rates, and accessibility to public companies all play an element on how a lot insurance coverage brokers make in a selected state or metropolis. An enormous metropolis with a dense inhabitants, as an illustration, affords quite a lot of alternatives for insurance coverage brokers to promote insurance coverage in comparison with a small city with fewer residents.

BLS’ web site has a software known as the OEWS Query System, the place you possibly can examine insurance coverage brokers salaries by state, metropolitan space, and non-metropolitan areas. Within the sections beneath, we are going to reveal how a lot insurance coverage brokers make within the following based mostly on the searches Insurance coverage Enterprise made utilizing the net software:

- 10 highest-paying states for insurance coverage brokers

- 10 lowest-paying states for insurance coverage brokers

- 10 highest-paying metro areas for insurance coverage brokers

- 10 lowest-paying metro areas for insurance coverage brokers

- 10 highest-paying non-metro areas for insurance coverage brokers

- 10 lowest-paying non-metro areas for insurance coverage brokers

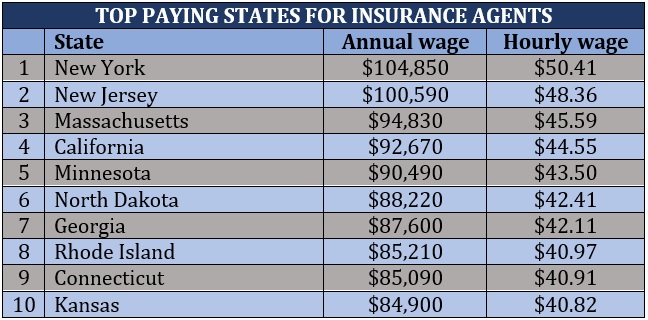

10 highest- and lowest-paying states for insurance coverage brokers

How a lot do insurance coverage brokers make within the highest- and lowest-paying states within the nation? Discover the solutions within the tables beneath.

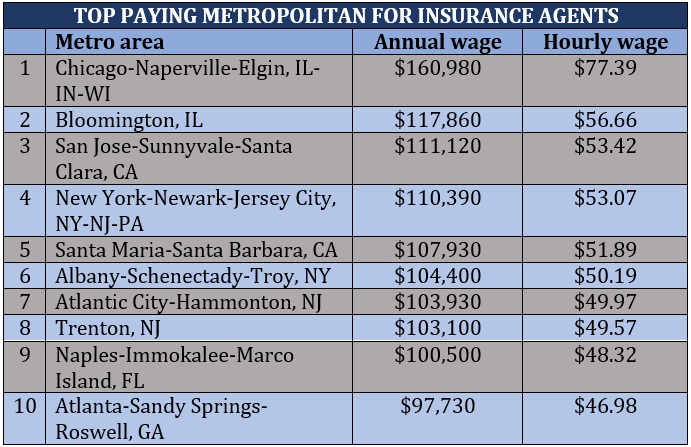

10 highest- and lowest-paying metro areas for insurance coverage brokers

These metropolitan areas pay insurance coverage brokers essentially the most and the least. Take a look at the figures beneath to learn the way a lot insurance coverage brokers make in these areas.

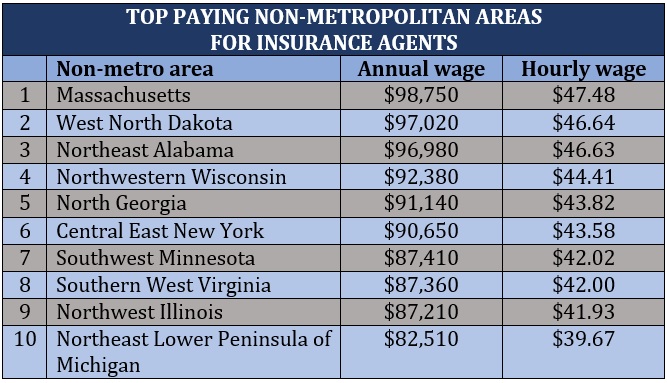

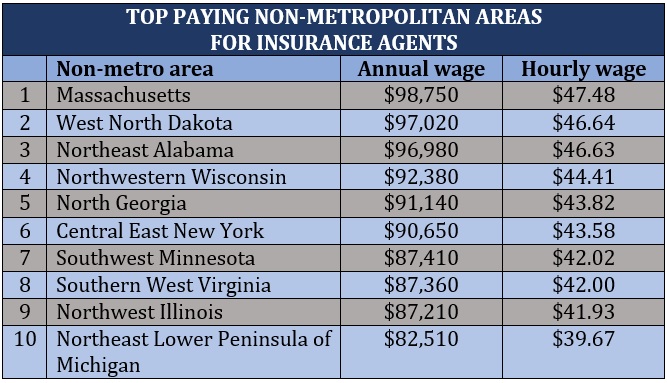

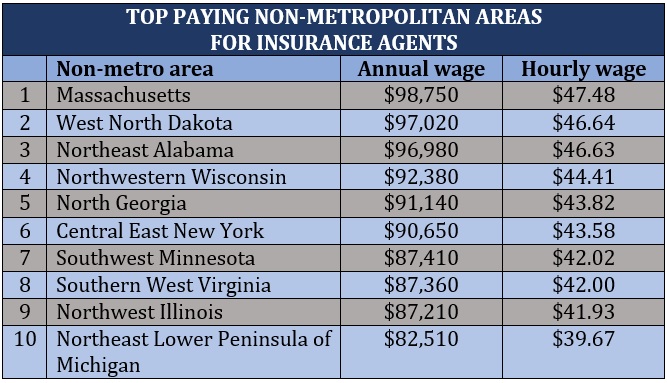

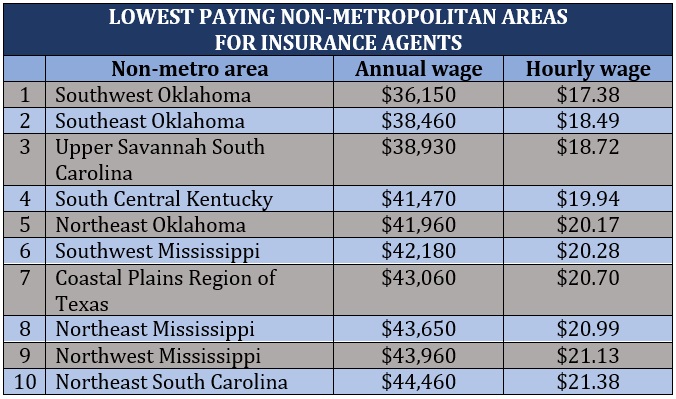

10 highest- and lowest-paying non-metro areas for insurance coverage brokers

In the meantime, in the event you’re questioning how a lot insurance coverage brokers make outdoors the large cities, the tables beneath element the common salaries of insurance coverage within the highest and lowest-paying non-metropolitan areas.

Similar to every other profession, being an insurance coverage agent has its personal execs and cons. Listed here are a number of the advantages and downsides of selecting insurance coverage gross sales as a profession path.

Professionals

Fewer entry boundaries

Insurance coverage brokers should adjust to licensing necessities, which range in every state. However aside from this, there a only a few entry boundaries for these eager to pursue this profession path. Though most corporations favor candidates with a school diploma, the function itself doesn’t require one. Largely, insurance coverage brokers be taught the ropes as they go about their jobs and thru numerous coaching applications.

Being an insurance coverage agent supplies an excellent residing wage that has a robust potential for progress. And with many insurance coverage brokers incomes revenue by way of commissions, in case you have an awesome work ethic and are prepared to position your self on the market to determine relationships with shoppers, extra alternatives to earn a better revenue will come your means.

Insurance coverage will at all times be in demand so long as persons are driving autos, shopping for houses, working companies, looking for medical remedy, and in want of monetary safety. BLS predicts that employment of insurance coverage brokers will rise around 6% within the subsequent decade. This determine is equal to about 52,700 new job openings yearly, largely to interchange those that have chosen to maneuver on to a different trade or retire.

Many insurance coverage brokers benefit from the freedom to set their work schedules. In case you select to grow to be one, you should have loads of alternatives to make money working from home, though you could typically want to fulfill with shoppers in-person outdoors your residence.

Alternative to vary lives

Being an insurance coverage agent might be each a rewarding and thrilling profession because it provides you the chance to vary individuals’s lives for the higher. By performing as an professional useful resource individual, insurance coverage brokers assist shoppers make knowledgeable choices about what varieties of protection supply them one of the best monetary safety.

Cons

Unpredictable revenue

Having a commission-based job like being an insurance coverage agent additionally has its drawbacks. Since your revenue relies totally on the amount of the gross sales you make, it may be tough to foretell how a lot your subsequent paycheck will likely be. Additionally, in the event you don’t push your self laborious, your revenue will replicate that.

In case you’re working as an impartial agent, then it means you don’t at all times have entry to a full vary of worker advantages. This implies you even have restricted paid time without work, particularly in the event you’re operating your individual enterprise. As well as, taking time without work means you’ll have to spend time away from constructing consumer relationships and searching for leads, which may price you a part of your earnings.

There are some individuals who deal with insurance coverage brokers with disrespect or disdain, and in your every day work, you could encounter individuals like them. You may additionally obtain quite a lot of no’s earlier than getting a sure, so having glorious individuals abilities and an impervious nature are important to achieve success on this profession.

In case you assume the professionals of being an insurance coverage agent outweigh the cons and are able to jumpstart a profession within the discipline, the easiest way to seek for a job is thru on-line channels. Discover out which websites you can go to find the best insurance jobs on this article.

To be a profitable insurance coverage agent, you have to possess a mix of laborious and smooth abilities that allow you to attach with shoppers and supply them one of the best protection potential. Listed here are a number of the most essential abilities and attributes that you need to should be top-of-the-line within the discipline.

- Folks abilities: The power to construct a relationship and keep belief with shoppers is essential for you to have the ability to discover out what protection they want and supply them with an appropriate coverage.

- Downside-solving abilities: As an insurance coverage agent, you’ll face distinctive challenges every day that may require you to provide you with inventive and modern options.

- Consideration-to-detail: You need to have the ability to take note of the finer particulars that affect the best way you supply your shoppers protection.

- Self-motivated: You need to have the intrinsic need to carry out to one of the best of your potential, even when this implies going a step additional to shut a sale.

- Communication abilities: You need to have robust written and verbal abilities, so you possibly can convey important data to shoppers in a easy and jargon-free means.

- Time administration: Insurance coverage brokers should have the power to prioritize duties and full tasks effectively.

- Negotiation abilities: The power to achieve a center floor with shoppers in instances of disagreement should be pure to you if you wish to be a profitable insurance coverage agent.

- Group: Since you may be working with completely different shoppers, you have to possess the power to maintain your data correct and arranged.

- Eagerness to be taught: Insurance coverage brokers should additionally present a robust willingness to be taught and hone new abilities.

Though typically confused with one another, there’s a large distinction between an insurance coverage agent and an insurance coverage dealer. If being a dealer is extra engaging for you, this step-by-step guide on how to become an insurance broker might help you.

Had been you stunned to know the way a lot insurance coverage brokers make? Do you assume the quantity needs to be greater or decrease? Chat us up within the feedback part beneath.

Associated Tales

Sustain with the most recent information and occasions

Be a part of our mailing listing, it’s free!