Bookkeeping is a riskier job than you would possibly suppose. That’s why it’s worthwhile to find out about E&O insurance coverage for bookkeepers.

A day within the lifetime of a bookkeeper is a busy one. You’re organizing and storing purchasers’ monetary data, money move statements, financial institution reconciliations, loss statements, and all cash issues in between. As a bookkeeper, you assist companies (and the occasional cousin, aunt, sister, or sister’s canine) hold their funds so as by managing their accounts and transactions. However, have you ever ever puzzled what would possibly occur in case you misplaced this delicate info, or if it was taken from you?

When you probably have a deal with on these varieties of economic dealings, you may be searching for help in what you are promoting’s danger administration. As an example, you possibly can be curious to know easy methods to correctly insure your organization to guard your livelihood from the unknown. It’s possible you’ll suppose that the enterprise of bookkeeping merely requires a general business owner’s policy, however usually, it’s simply not that easy. The truth is, Errors & Omissions Insurance coverage for bookkeepers could also be much more essential.

Fortunate for you, we all know insurance coverage. And we’ll cowl all the pieces it’s worthwhile to know for what you are promoting, together with why you’ll wish to look into buying Errors and Omissions protection.

What’s Errors and Omissions Insurance coverage?

First, let’s outline what an Errors and Omissions Insurance coverage coverage is and what it might probably cowl. Additionally known as E&O Insurance coverage or Professional Liability Insurance, these insurance policies can defend bookkeepers from unintentional errors or errors.

The truth that a few of what this coverage covers is spelled out in its identify might assist you higher wrap your thoughts round what it’s supposed to guard in opposition to.

Bookkeepers could seem superhuman to the mathematically challenged and organizationally hostile, however bookkeepers are actually simply folks. And people make errors. There it’s once more–that phrase: errors.

It’s completely attainable that you simply would possibly make a mistake, overlook one thing or miscommunicate to a consumer. The unlucky truth of life although is that any error or omission you make may lead to a lawsuit–particularly once you’re coping with folks’s cash.

Errors & Omissions insurance policies are put in place to assist cowl what you are promoting within the occasion of an unplanned mishap. It’s insurance coverage that retains you and your organization shielded from civil lawsuits for negligence, widespread errors, omissions and misrepresentation claims.

With regards to E&O insurance coverage for bookkeepers, although, you’ll want just a few extra particulars.

The Advantages of E&O Insurance coverage for Bookkeepers

Errors and Omissions Insurance coverage will assist defend your bookkeeping enterprise from a lawsuit made on the declare that errors had been made by you or your organization. Maybe you misplaced a consumer’s monetary data in an workplace transfer or forgot to file an extension for a mandated tax audit.

Positive, human error might account for a lot of potential errors, however with 58% of US accountants utilizing automation to extend productiveness and already 20% of US accounting companies utilizing synthetic intelligence, machine-made errors are certain to occur too. We’ve all seen iRobot, proper?

E&O insurance coverage for bookkeepers would cowl the prices that outcome from authorized motion incurred by any form of wrongdoing.

It’s price noting that this coverage will solely cowl unintentional errors. Deliberately deceptive a consumer is just not one thing that may be lined.

Fast Tip: Hold a file of any consumer agreements, SOWs and transactions made in an effort to show any misunderstanding or mistake was not made on goal. It’s not a “get out of jail free card”, but in addition strong safety for trustworthy errors.

In the event you don’t have an E&O insurance coverage for bookkeepers coverage in place, you and your organization will probably be chargeable for no matter settlement price is decided–to not point out authorized charges. Past that, you will have to spend time in your protection and may lose alternatives to work with different purchasers in consequence. Plus, as if making a mistake and having to pay for it wasn’t dangerous sufficient, not having any help all through the retribution course of may be downright soul crushing. In lots of circumstances, E&O insurance coverage for bookkeepers will give you authorized protection and counsel–and having that assist all through the litigation could make all the distinction.

The place & The way to Get E&O Insurance coverage for Bookkeepers

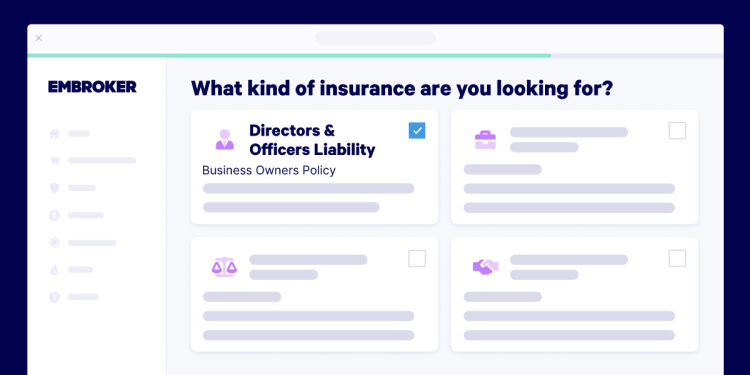

You’ll find an Errors and Omissions coverage at any credible insurance coverage brokerage. That being stated, you could wish to begin with an organization that provides customized insurance policy. This manner you’ll be able to bundle the varied insurance policies it’s worthwhile to get probably the most complete plan.

For instance, Embroker’s policies defend in opposition to claims of errors and omissions in your work they usually also can defend your private belongings within the occasion that you simply turn out to be susceptible to a lawsuit.

The price of Errors and Omissions Insurance coverage for bookkeepers depends upon a variety of components, together with your trade, protection limits, the dimensions of your organization and any prior lawsuits. However relaxation assured realizing that Embroker will discover you one of the best protection for one of the best worth.

Different Necessary Insurance coverage Coverages for Bookkeepers

E&O insurance coverage for bookkeepers is a will need to have coverage. However, you’ll additionally wish to think about acquiring a few of these different kinds of insurance coverage insurance policies too:

- Business Owner’s Policy: This sort of insurance coverage will embody a mix of protection sorts together with a bundle of normal legal responsibility and business property insurance coverage.

- Commercial Auto Insurance: Just like private auto insurance coverage, this coverage would cowl automobiles used for enterprise functions, together with firm automobiles within the circumstance the place you could have varied staff who might journey for consultations or gross sales pitches.

- Workers’ Compensation: One other insurance coverage coverage you’ll wish to have in case you run your personal bookkeeping enterprise and have a number of staff, Employees’ Compensation insurance coverage will cowl care and compensation of people in your employees in the event that they get injured whereas at work in your workplace house or whereas touring for work-related causes. Actually, slip-and-falls occur extra usually than you suppose.

- Cyber Liability Insurance: You may also wish to think about acquiring cyber legal responsibility insurance coverage. As , bookkeeping isn’t a stack of papers on the tip of a desk anymore. You’re employed with delicate monetary data digitally, and may defend in opposition to the potential hacking of this info.

Embroker’s crew of insurance coverage professionals is right here to assist as a result of we all know that navigating your insurance coverage wants isn’t straightforward or easy. And that’s why we work with you from begin to end–and are at all times only a name or message away.

What are you paying for?

Store your quote, and get one of the best fee. Add your coverage for a quick, aggressive worth.