The easiest way to hurry the underwriting course of up will likely be to get your examination accomplished as early as attainable in order that your outcomes get again to the insurance coverage firm quicker.

Should you want probably the most reasonably priced charges and are effective with a 2 to three week flip round, then getting term life insurance rates and protection from Banner is the perfect reply.

Who Is Banner Life Insurance coverage?

Banner Life was based in 1949 which makes it 70 years outdated.

An insurance coverage firm’s age is essential as a result of it reveals that they don’t seem to be going wherever and have longevity.

Banner is a subsidy of the mum or dad firm for Authorized & Common America and is understood for his or her sturdy monetary standing and nice customer support.

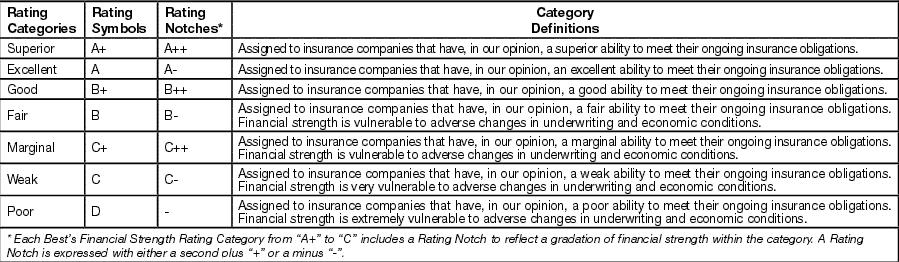

Banner Life Insurance coverage Firm has a ranking of A+ (Superior) from A.M. Finest.

Why Ought to You Care About A.M. Finest?

I like to think about A.M. Best just like the JD Energy of the insurance coverage business, they’ve been round for over 117 years. They charge firms primarily based primarily on their monetary power, which may be an indicator or claims-paying capacity.

What Makes Them Completely different?

What makes Banner Life Insurance coverage Firm totally different is that they provide life insurance coverage as much as age 95.

That is properly above the business customary of often stopping between the ages of 65 or 75. In addition they supply very versatile fee choices and a number of time period limits for every coverage kind.

Banner is providing over $1 Million in life insurance coverage protection with a brief on-line software and really agreeable underwriting.

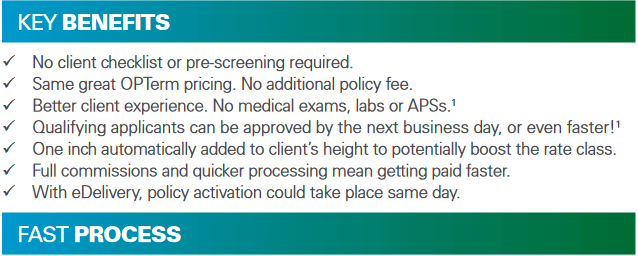

They’re additionally making an attempt to make some actions within the accelerated life software sector with their new APPcelerate Product.

Banner Life APPcelerate Time period Life Possibility

Like a lot of the best term life insurance companies, Banner Life is making an attempt to maneuver in the direction of an automatic and accelerated life insurance coverage underwriting course of.

Due to this, some candidates could not need to take an examination

In addition they would possibly have the ability to keep away from medical data requests as properly.

You’ll be able to apply for as much as $500,000 in case you are between ages 20-50 and could also be permitted for protection with out the necessity of exams, labs, or medical data.

The APPcelerate merchandise options are:

Keep in mind, “No Examination” does not imply “No Underwriting,” there are nonetheless experiences pulled to be sure you qualify for protection comparable to:

Banner is working to provide the better of each worlds, if you cannot qualify for the APPcelerate choice, you’ll in all probability have the ability to qualify for the absolutely underwritten choice.

What Are The Finest Banner Life Insurance coverage Alternate options?

How Does Banner Life Insurance coverage Work?

Banner is concentrated on reasonably priced life insurance coverage charges with stable underwriting.

Their insurance policies are often good for individuals with pre-existing situations or tobacco customers.

Their life insurance coverage course of works like this:

Protection To Age 95

There is no such thing as a different product out there that may help you apply for all times insurance coverage as much as you’re age of 95.

This implies it would not matter what a part of life you’re in you may apply for all times insurance coverage.

Digital Utility

The applying course of is digital, easy and brief, it should often take lower than 5 to 10 minutes to finish all the data and submit your software.

Accelerated Underwriting

This a part of the method is simple, you will reply just a few questions on your way of life and medical scenario through a phone interview.

When you do this, Banners’s in-house underwriting system will determine how you can proceed together with your software.

Should you qualify for the APPCelerate choice you can be permitted primarily based on that interview and protection can begin instantly.

Should you do not qualify you can be despatched into the normal underwriting course of.

Coverage Delivered By way of E-mail

As soon as your coverage has been permitted and issued you’ll obtain a replica of it on to your e mail deal with.

That is nice as a result of you do not have to recollect the place you left your coverage and can all the time have quick access to it.

What Does Banner Life Insurance coverage Cowl?

Banner life presents just a few totally different coverage choices so that you can select from.

Every coverage comes with protection choices from $100,000 as much as $1,000,000+.

10 Yr Time period Life Insurance coverage Coverage

The ten yr time period life choice goes to cowl you for 10 years earlier than it is time to buy a brand new coverage.

This coverage goes to be probably the most reasonably priced choice with low-range pricing and will likely be finest for people who find themselves taking a look at each their brief time period and long run wants.

The quantity of life occasions that may occur in 10 years is huge and being ready for them is essential.

A ten yr time period is a good place to begin and locking your low charges in goes to be important.

15 Yr Time period Life Coverage

The fifteen yr time period life choice goes to cowl you for 15 years earlier than you need to buy a brand new coverage.

This coverage goes to be the second most reasonably priced and be finest for people who find themselves in the midst of life occasions like having a child or switching jobs.

20 Yr Time period Life Insurance coverage Coverage

The twenty yr time period life coverage would be the second costliest of the 4; nonetheless, it should nonetheless be very reasonably priced.

This time period size goes to be finest for somebody centered very a lot so on their future and wish to be lined for probably the most prolonged time frame with the utmost quantity of financial savings.

The longer a time period size a coverage has, the dearer it is going to be up-front; nonetheless, the extra financial savings you’ll get over time.

If you realize what you need and may afford the twenty yr time period choice, then I’d recommend you go together with the 20 yr time period choice.

30 Yr Time period Life Insurance coverage Coverage

The thirty yr time period life coverage would be the costliest of the 4; nonetheless, it should nonetheless be reasonably priced.

This time period size goes to be finest for somebody centered on their future and wish to be lined for probably the most prolonged time frame with the utmost quantity of financial savings.

The longer a time period size a coverage has, the dearer it is going to be up-front; nonetheless, the extra financial savings you’ll get over time.

If you realize what you need and may afford the thirty yr time period choice, then I’d recommend you go together with it.

It is a actually good choice should you simply bought a house.

All Trigger Demise Profit

All of those insurance policies pays out for every type of loss of life from unintentional loss of life, terminal sickness, vital sickness or persistent sickness.

With all insurance coverage insurance policies, there are some limitations so remember to learn the coverage for issues that are not lined.

Banner Life Free MediGuide Membership

Not like another life insurance coverage firm on the market, Banner life presents free membership to MediGuide with all of their insurance policies.

So, Should you’ve been recognized with an sickness which may contain any kind of coronary heart illness, most cancers, or another high-risk situation you will get a second opinion at no cost.

If in case you have by no means heard of MediGuide then you’re in for a deal with.

MediGuide is a service that permits you to get a second opinion from a qualifed physician in case you are recognized with a life-threatening sickness.

Banner will enable you to discover the highest 3 medical facilities that deal with your situation.

After you and your major doctor have recognized the suitable medical middle, MediGuide & Banner will get you the second opinion from a high medical middle.

This middle might have entry to superior applied sciences that your major physician could not have.

Better of all, once more, it is Free and why Banner is constantly in our record of high life insurance coverage firms to work with.

Banner Life Insurance coverage Merchandise

Considered one of their major merchandise is their OPTerm Life product which we element under:

OPTerm

The OPTerm is Banner Life’s traditional term life insurance product and has a number of the finest underwriting outcomes for substandard well being profiles.

This coverage is renewable all the way in which till 95 and has assured degree premiums with the power to transform the coverage.

It’s also possible to convert this coverage into a complete life coverage by following the under tips:

If issued earlier than age 66, the coverage is convertible till the sooner of the tip of the time period interval or as much as age 70. If issued at age 66 or later, insurance policies are convertible throughout the first 5 coverage years.

A few of the optionally available riders out there are:

Youngster Safety Rider – Gives life insurance coverage protection for all eligible youngsters (as much as their twenty fifth birthday)

Waiver Of Premium Rider – Should you turn out to be completely disabled because of a qualifying occasion, premiums are waived (after a 6 month ready interval). Rider ends at age 65.

Accelerated Demise Profit Rider – You’ll be able to speed up as much as 75% of the loss of life profit (as much as a max of $500,000) should you’ve been recognized with a qualifying terminal sickness.

Banner Life Charges & Comparisons

Simply to present you an concept, under I wished to match Banner life charges with a number of firms.

A 20 Yr, 500,000 Time period Coverage for a 30 yr outdated male in excellent well being and a non-tobacco consumer, see the outcomes under:

As you may see, Banner’s charges are proper in step with different firms; nonetheless, their included advantages just like the free membership to MediGuide makes it a significantly better deal.

If you’d like the bottom value and finest worth then the OPTerm product is the best choice.

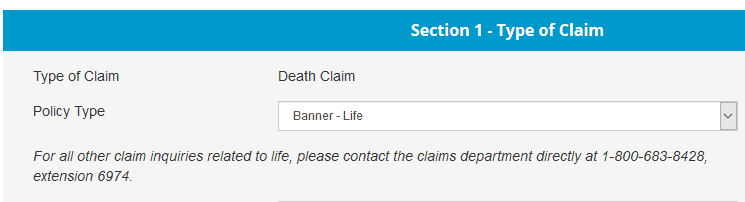

How Banner’s Claims Course of Works

Banner presents a easy and clear rationalization of how you can deal with a declare on their web site.

It’s also possible to select if they need to observe up through e mail, fax, or telephone.

Their claims course of appears to be very simple, when you full the net type they may ship the declare’s packet out to you to finish the method.

Are There Any Declare Exclusions

There are just a few exclusions when paying out on a life insurance coverage declare.

The exclusions embody loss of life from suicide (throughout the first 2 years of protection), which is customary for nearly all life insurance coverage insurance policies.

As all the time, please learn the coverage specifics when it arrives within the mail; nonetheless, these are some normal exclusions which is business customary for many insurance policies.

Banner Life’s Availability & Coverage Choices

To qualify for the Banner Time period life insurance coverage coverage, you should:

How To Take Motion

No different Banner Life Insurance coverage Evaluations are so long as mine; nonetheless, I wished to guarantee that I gave as a lot element as attainable.

If in case you have been holding off on shopping for life insurance coverage for any cause, I say give the 30-day free look interval a shot. With the accelerated underwriting course of, you not need to be afraid of the life insurance coverage shopping for course of, it is so quick, you will not understand it is over, and your protection has began.

And guess what, should you do not qualify for the accelerated course of that’s completely effective, you’ll nonetheless have the ability to get the bottom charges if you need to full an examination.